Summary

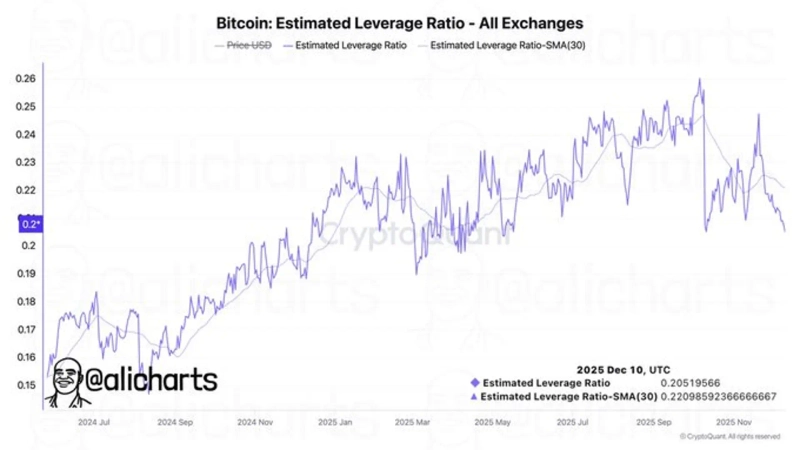

- It reported that the Bitcoin (BTC) futures market's leverage usage has fallen to its lowest level this year.

- It said that as investors moved to avoid risk, the leverage investment ratio decreased to its lowest level since May and the large-scale liquidations last October.

- This indicates that aggressive positions through borrowing in the futures market have decreased and that investors are taking defensive strategies.

The leverage utilization across the Bitcoin (BTC) futures market has fallen to its lowest level so far this year.

On the 15th, according to crypto asset-focused media BlockBeats, analyst Ali Martinez, citing CryptoQuant data, said, "As investors moved to avoid risk, the Bitcoin leverage investment ratio fell to its lowest level since May and the 'large-scale liquidations last October.'"

The drop in the leverage ratio means that aggressive position building through borrowing in the futures market is decreasing. This is interpreted as a sign that investors are reducing position sizes and adopting defensive strategies amid a phase of increased price volatility.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)