Editor's PiCK

Digital asset investment products see net inflows for three consecutive weeks…Investor sentiment gradually recovering

Summary

- It reported that the digital asset investment products market has seen net inflows for three consecutive weeks, with investor sentiment gradually recovering.

- The United States, Germany and Canada account for 98.6% of total inflows, and it highlighted assets to watch such as Bitcoin, Ethereum, Chainlink, Solana.

- CoinShares analyzed that price movement has been limited after rate cuts, but inflows continue, and investors are expanding digital asset exposure on a medium- to long-term basis.

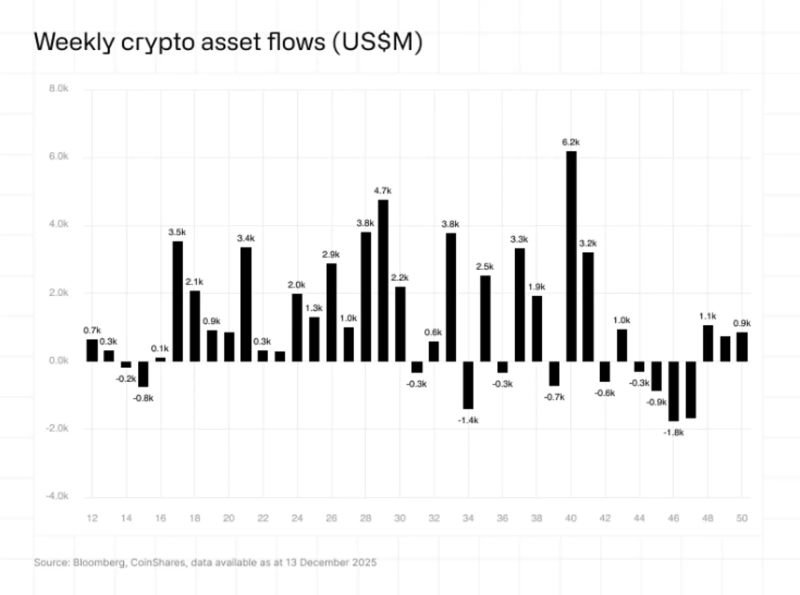

Net funds have flowed into the digital asset investment products market for three consecutive weeks, indicating that investor sentiment is gradually improving. However, some assessments say that price movements have remained limited even after the U.S. Federal Reserve (Fed) cut interest rates.

On the 15th, according to digital asset (cryptocurrency) asset manager CoinShares, digital asset exchange-traded products (ETPs) recorded total net inflows of $716 million last week. As a result, total assets under management (AuM) rose to $180 billion, but this still falls short of the record high of $264 billion.

By region, the United States accounted for the largest share with inflows of $483 million, followed by Germany ($96.9 million) and Canada ($80.7 million). CoinShares explained that, on a year-to-date basis, the United States, Germany and Canada together account for 98.6% of total inflows.

By asset, Bitcoin recorded net inflows of $352 million. Meanwhile, short (short-selling) Bitcoin products saw outflows, suggesting that negative sentiment in the market is easing. XRP attracted $245 million in inflows, and Chainlink (LINK) recorded net inflows of $52.8 million. For Chainlink, this amounts to 54% of its assets under management and is the largest weekly inflow on record.

Notably, Ethereum recorded net inflows of $338 million last week, bringing year-to-date cumulative inflows to $13.3 billion. This represents a 148% increase year-on-year.

Solana has seen $3.5 billion in year-to-date inflows, a tenfold increase compared to 2024, and Aave (AAVE) recorded net inflows of $5.9 million last week. Conversely, Hyperliquid (HYPE) experienced net outflows of $14.1 million.

CoinShares said, "Although price reactions have been limited following U.S. rate cuts, flows are gradually improving," adding, "Investors remain cautious but are increasing their exposure to digital assets from a medium- to long-term perspective."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)