Editor's PiCK

Last week $950 million net outflow from digital asset investment products…"Impact of Clarity Act delay"

Summary

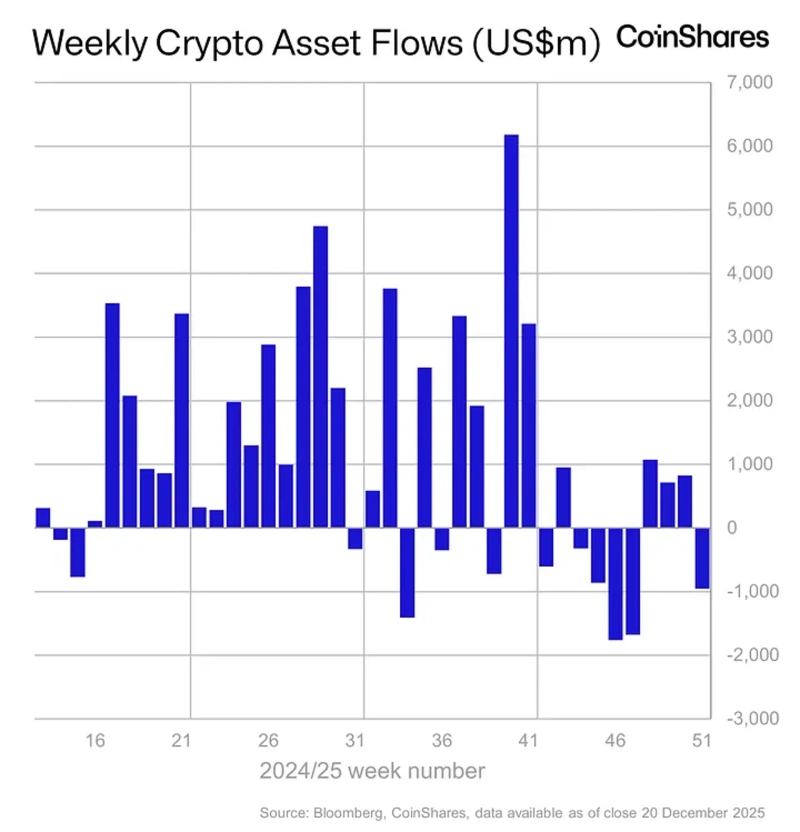

- Last week, digital asset investment products recorded net outflows of $950 million, reversing three straight weeks of inflows in the first reversal in four weeks.

- It said that regulatory uncertainty in the U.S., delays in passage of the 'Clarity Act', and concerns about selling by large holders have dampened market sentiment.

- It reported large net outflows from Ethereum and Bitcoin, while Solana and XRP saw selective inflows.

Digital asset (cryptocurrency) investment products saw net outflows of about $950 million last week, reversing three consecutive weeks of inflows in the first reversal in four weeks.

On the 22nd (local time), crypto asset specialist asset manager CoinShares said that digital asset ETPs (exchange-traded products) recorded total net outflows of $950 million last week. Selling pressure was concentrated on Ethereum and Bitcoin, while selective inflows continued into some altcoins. Analysts interpret this as large-scale outflows from the digital asset investment product market as U.S. regulatory uncertainty resurfaced.

CoinShares said in the report, "The delay in passage by the U.S. Congress of the 'Clarity Act' has prolonged regulatory uncertainty, and concerns over continued selling by large holders (whales) have dampened market sentiment." As a result, it is assessed that cumulative inflows into digital asset ETPs this year are unlikely to surpass last year's level. Total assets under management (AUM) currently stand at $46.7 billion, below last year's year-end level of $48.7 billion.

Regionally, outflows were essentially concentrated in the U.S. The U.S. saw net outflows of $990 million, while Canada and Germany recorded net inflows of $46.2 million and $15.6 million, respectively, partially offsetting this.

By asset, Ethereum investment products were most affected with net outflows of $555 million. The report explained, "Ethereum is the asset most affected by potential benefits or uncertainties depending on whether the Clarity Act passes." However, on a year-to-date basis, inflows into Ethereum investment products total $12.7 billion, far exceeding $5.3 billion in the same period last year.

Bitcoin investment products also saw net outflows of $460 million. Bitcoin's year-to-date inflows are $27.2 billion, showing a slowdown compared with $41.6 billion in the same period last year.

Meanwhile, Solana and XRP saw net inflows of $48.5 million and $62.9 million, respectively. The report said, "This shows that despite overall market weakness, selective investor demand remains for certain assets."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.