Summary

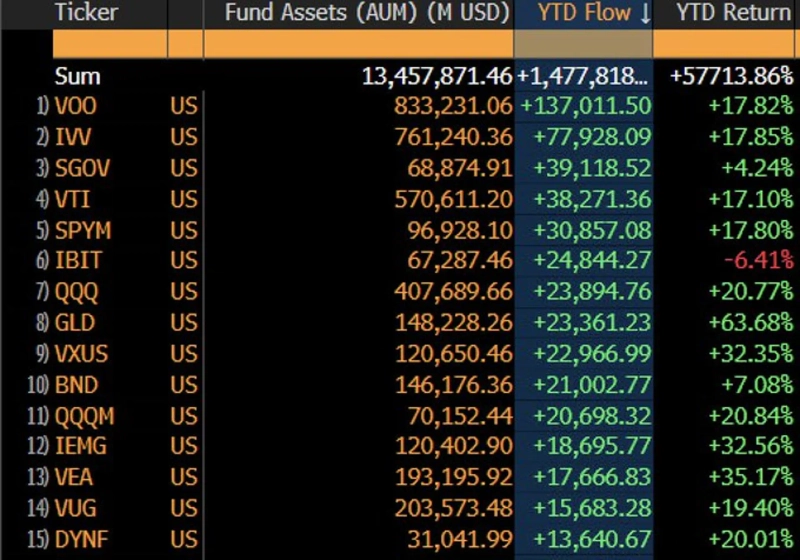

- BlackRock's spot Bitcoin ETF (IBIT) remained 6th by ETF assets last year.

- IBIT's assets under management were reported at 248.44 billion dollars.

- Due to Bitcoin's price weakness, IBIT recorded an annual return of -6.41%, making it the only one among the top 15 ETFs to post a negative return.

BlackRock's spot Bitcoin (BTC) exchange-traded fund (ETF) remained among the top ETFs by assets last year. However, returns lagged due to Bitcoin's weakness.

On the 3rd (Korean time), Eric Balchunas, a Bloomberg ETF analyst, released 2025 ETF performance data via X(formerly Twitter).

According to the data, total ETF assets under management last year increased by 28% year-on-year, reaching a record high of 1.48 trillion dollars.

BlackRock's IBIT ranked 6th among all ETFs with assets under management of 248.44 billion dollars. However, as Bitcoin was weak last year, IBIT posted a return of -6.41%, making it the only one among the top 15 ETFs to record a negative annual return.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.