- Tom Lee of Bitmain predicted that Ethereum could hit an all-time high this year based on institutional demand and the expansion of real-world asset tokenization.

- Ethereum is drawing attention for its potential use as financial infrastructure, as major companies such as Bitmain, which currently hold 3.41% of the total supply, continue purchases.

- However, recent large net outflows from spot Ethereum ETFs and a clear absence of price rebound are considered burdens from a short-term investment perspective.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Crypto Now

Up to 9,000 dollars due to increased institutional demand

Ethereum, the leading altcoin (cryptocurrencies other than Bitcoin), could hit an all-time high this year against the backdrop of expanded institutional demand.

According to industry sources on the 4th, Tom Lee, chairman of Bitmain, known as the world's largest holder of Ethereum, recently said in an interview with CNBC, "If institutional investors' tokenization of real-world assets and on-chain finance experiments get underway, the price of Ethereum could rise to $7,000–$9,000 early this year." He said, "Ethereum is an infrastructure that can provide efficiency to the traditional financial system and build real use cases," adding, "In the long term, $20,000 is also possible."

As of the 29th of last month, Bitmain holds 4,110,525 Ethereum. This corresponds to about 3.41% of the total circulating supply of Ethereum. Bitmain has continued purchasing Ethereum even in the bear phase and aims to secure 5% of the total supply in the long term.

Institutions and the financial sector are paying attention to the potential use of Ethereum as financial infrastructure. Cryptocurrency-focused media Cointelegraph reported, "The real-world asset (RWA) tokenization market grew rapidly from about $5.6 billion to $18.9 billion just last year." It added, "Currently, more than $12 billion of tokenized assets are stored on the Ethereum network, which far exceeds major competing blockchains such as Solana."

Despite these optimistic forecasts, the price of Ethereum has not shown a clear rebound. On domestic cryptocurrency exchange Upbit, Ethereum has been trading sideways around 4.4 million won recently after falling below the 5 million won level in November last year. Industry insiders say that the large-scale infrastructure update applied to the Ethereum mainnet in early last month, the 'Fusaka(Fusaka)' upgrade, has not had a clear impact on short-term price movements, contrary to its technical improvements.

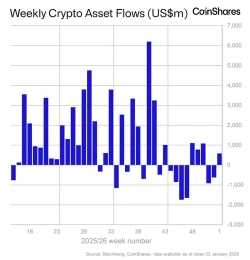

Spot Ethereum exchange-traded funds (ETFs) listed in the United States recorded net outflows of $616.8 million (about 890 billion won) last month. According to the industry, total funds withdrawn from spot Bitcoin and Ethereum ETFs over the past month amounted to $1.7 billion (about 2.4519 trillion won).

Kang Min-seung, BloomingBit reporter minriver@bloomingbit.io