PiCK

US spot Bitcoin ETF sees $683 million net outflow last week…trading value rebounds

Summary

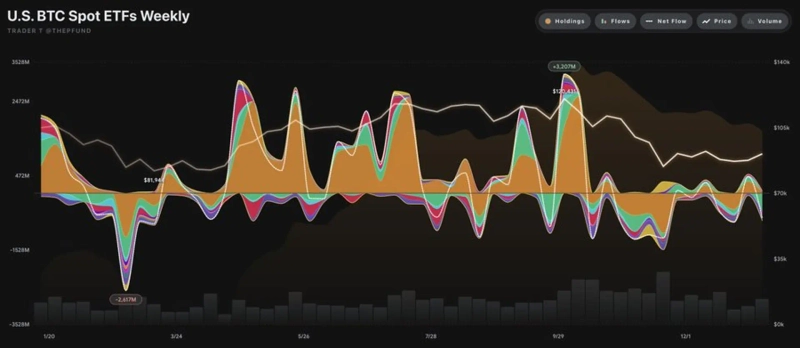

- US spot Bitcoin ETFs posted a $683 million net outflow last week, it said.

- Over the same period, trading value came in at about $20 billion, indicating trading activity resumed versus the previous week, it said.

- Despite the recovery in trading value, the net outflow remains large, prompting assessments that institutional flows are staying cautious, it said.

Forecast Trend Report by Period

Outflows from US spot Bitcoin (BTC) exchange-traded funds (ETFs) continued, while trading value showed signs of recovering.

According to Trader T on the 12th (local time), US spot Bitcoin ETFs posted a net outflow of $683 million last week (about KRW 998.6 billion). Over the same period, trading value totaled about $20 billion, suggesting a resumption of trading activity from the prior week.

Flows diverged by issuer. BlackRock recorded a $24 million net inflow, while Fidelity saw $481 million pulled out. Grayscale also posted a $194 million net outflow.

Market participants interpret the rebound in trading value as a signal of rising short-term price volatility and increased trading demand, but with net outflows still sizeable, assessments point to institutional flows maintaining a cautious bias. Whether outflows ease going forward is being cited as a key variable for gauging stability in the spot Bitcoin ETF market.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)