PiCK

US spot Bitcoin ETF sees $100 million in net inflows...for a fourth straight session

Summary

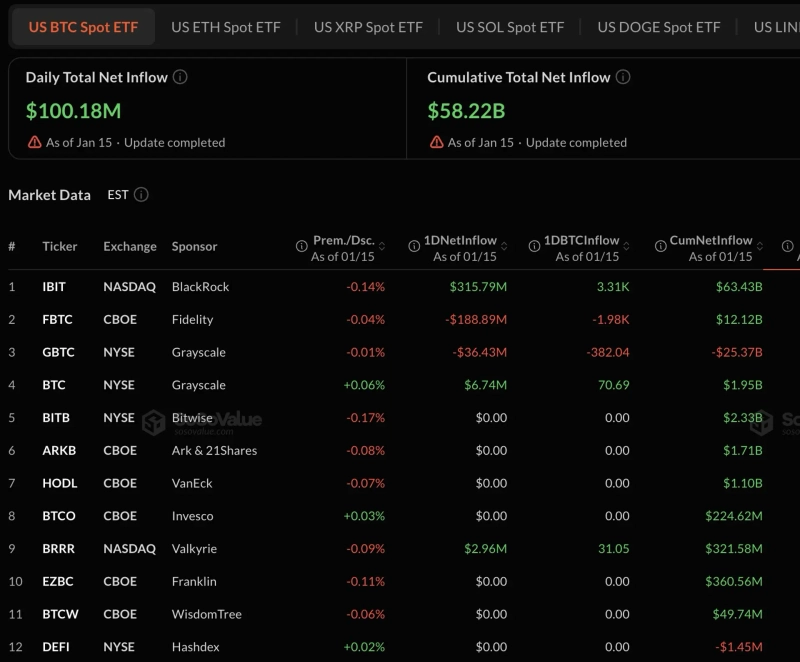

- The US spot Bitcoin ETF market extended its net inflow streak to a fourth consecutive trading session, posting daily net inflows of $100.18 million.

- BlackRock’s IBIT drew $315.79 million in a day, keeping the top spot with cumulative net inflows of $63.43 billion.

- Fidelity’s FBTC and Grayscale’s GBTC recorded net outflows of $188.89 million and $36.43 million, respectively, while Grayscale’s BTC and Valkyrie’s BRRR saw modest inflows.

Forecast Trend Report by Period

The US market for spot Bitcoin (BTC) exchange-traded funds (ETFs) extended its net inflow streak to a fourth consecutive trading session.

According to data from SosoValue on the 15th (local time), daily net inflows into US spot Bitcoin ETFs totaled $100.18 million. Cumulative net inflows reached $58.22 billion.

BlackRock’s IBIT led the inflows. IBIT attracted $315.79 million in a single day, and its cumulative net inflows held the top spot at $63.43 billion.

By contrast, Fidelity’s FBTC posted net outflows of $188.89 million, while Grayscale’s GBTC also recorded net outflows of $36.43 million. Grayscale’s BTC, however, saw $6.74 million of inflows. Valkyrie (BRRR) also logged a modest inflow of $2.96 million.

Several ETFs—including Bitwise (BITB), ARK 21Shares (ARKB), VanEck (HODL), and Invesco (BTCO)—were flat on the day with no net inflows or outflows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)