Summary

- Ethereum staking demand has surged, with reports saying the validator withdrawal queue is at zero.

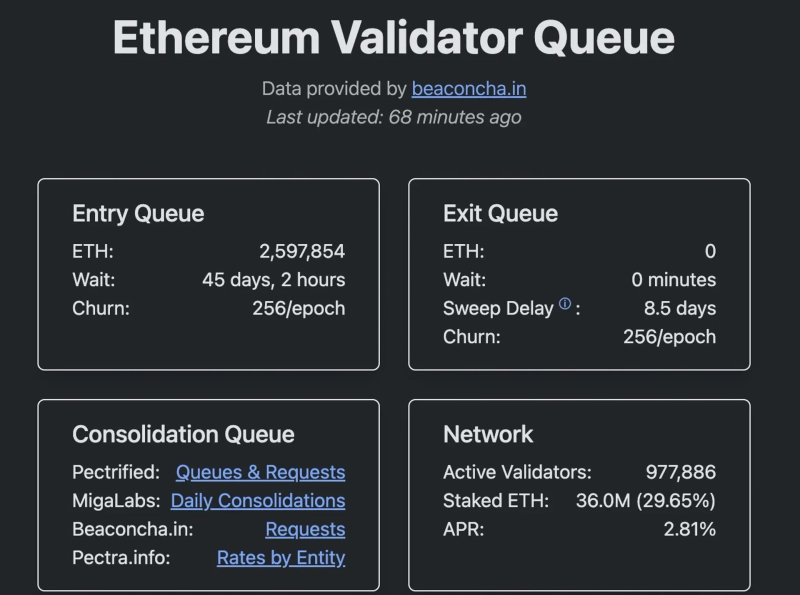

- The entry queue for new staking has increased more than fivefold over the past month, climbing to 2.6 million.

- The industry says institutional participation and the staking ratio approaching an all-time high are signals of a mid- to long-term bullish trend.

Ethereum (ETH) staking demand appears to be surging.

On the 18th (Korea time), cryptocurrency news outlet Cointelegraph, citing Validator Queue data, reported that the Ethereum validator withdrawal queue currently stands at zero. Validator withdrawals refer to attempts to exit Ethereum staking.

As recently as September, the Ethereum validator withdrawal queue had piled up to 2.67 million, but that backlog has been fully cleared in about four months. By contrast, the entry queue for new staking has jumped more than fivefold over the past month, surging to 2.6 million.

While the waiting period for new staking takes about 45 days, withdrawal requests are being processed within minutes.

The industry believes this trend could improve Ethereum’s supply-and-demand structure and help set the stage for mid- to long-term price gains. Leon Waidmann, head of research at Onchain Foundation, said, "If the amounts in the entry queue convert into active validators, the staking ratio will approach an all-time high," adding that it is "a signal suggesting a bullish trend over the coming months."

Institutional investors’ participation is seen as a key driver behind the rise in staking demand. Bitmine, Ethereum’s largest treasury company, is said to have recently staked more than 1.25 million—equivalent to one-third of its total holdings.

As of 2:23 p.m. this day, Ethereum was up 0.75% from the previous day at $3,313, according to CoinMarketCap.

![[Key economic and cryptocurrency events for the week ahead] US President Donald Trump’s Davos Forum speech, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)