Ki Young Ju: “Bitcoin institutional demand still strong… net inflows of 577,000 BTC over the past year”

Summary

- Ki Young Ju, CEO of CryptoQuant, said institutional demand for Bitcoin remains strong, with net inflows of about 577,000 BTC over the past year.

- He said the figure, equivalent to roughly $53 billion, was calculated based on U.S. custody wallets and holdings of U.S. spot Bitcoin exchange-traded funds (ETFs).

- The market assesses that, separate from short-term price adjustments, institutional inflows support Bitcoin’s medium- to long-term supply-demand structure, while noting that due to macroeconomic variables and geopolitical risks, an immediate price rebound requires further confirmation.

Forecast Trend Report by Period

An analysis suggests that Bitcoin demand led by institutional investors has remained resilient even amid the recent bout of volatility.

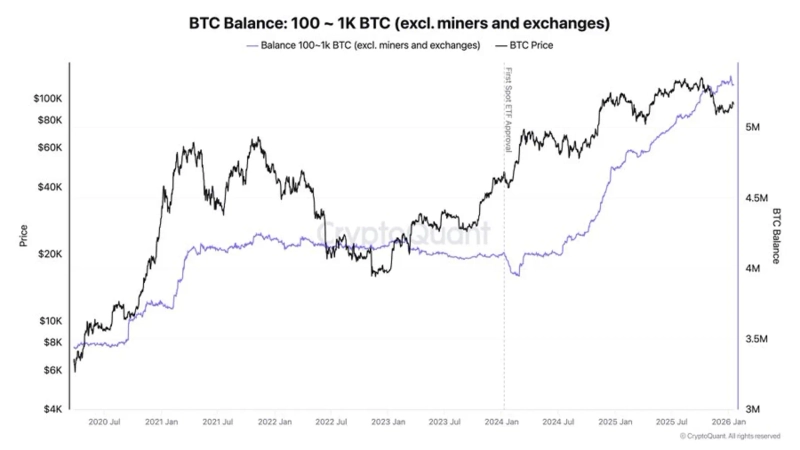

On the 20th (local time), Ki Young Ju, CEO of CryptoQuant, said, “Institutional demand for Bitcoin is still strong,” adding, “Over the past year, there has been a net inflow of about 577,000 BTC, and inflows are continuing even now.” This corresponds to roughly $53 billion in dollar terms.

Ju cited custody wallet data in the United States as the basis. In general, U.S. custody wallets used by institutional investors often hold 100–1,000 BTC per wallet; excluding exchanges and miner wallets, they can serve as an indicator for gauging institutional demand. This figure also includes holdings of U.S. spot Bitcoin exchange-traded funds (ETFs).

Market participants say that, apart from short-term price pullbacks, continued institutional inflows could support Bitcoin’s medium- to long-term supply-demand dynamics. However, with macroeconomic variables and geopolitical risks also contributing to heightened short-term volatility, some analyses add that further confirmation is needed on whether institutional demand will translate into an immediate price rebound.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)