"Bitcoin Sees Rising Inflows to Derivatives Exchanges…Sentiment Gauge May Improve"

Summary

- The analyst said market sentiment is gradually improving alongside increased inflows of Bitcoin (BTC) to derivatives exchanges.

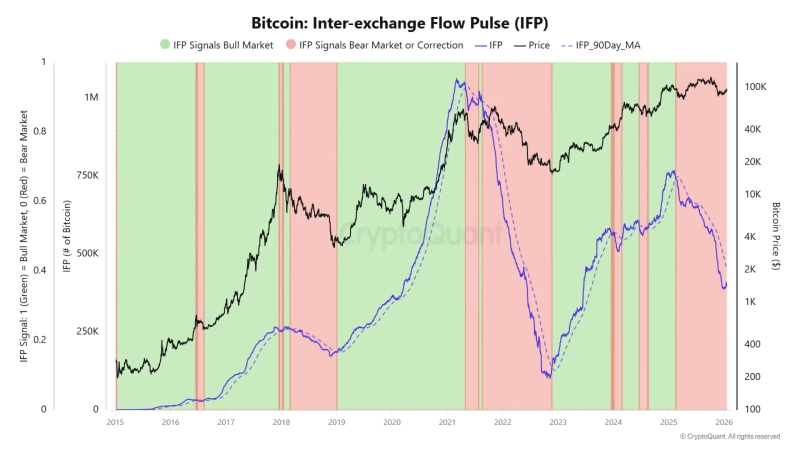

- CryptoQuant’s Inter-Exchange Flow Pulse (IFP) indicator has turned upward after passing a low, which was described as being linked to a rising share of leveraged trading.

- As the gap between the IFP and the 90-day moving average (90MA) narrows, a golden cross between the two could be interpreted as a medium-term bullish reversal signal.

Forecast Trend Report by Period

An analysis suggests that market sentiment is gradually improving as inflows of Bitcoin (BTC) to derivatives exchanges increase.

On the 20th, analyst CW8900 said in a CryptoQuant Quicktake report that "the ‘Inter-Exchange Flow Pulse (IFP)’ indicator, which shows Bitcoin’s inter-exchange fund flows, has turned upward after passing a low."

The IFP tracks the flow of Bitcoin moving from spot exchanges to derivatives exchanges and is used to gauge market participants’ positioning preferences and sentiment. Generally, rising Bitcoin inflows to derivatives venues tend to increase the share of leveraged trading and often coincide with bullish phases.

The analyst assessed that, alongside the recent uptick in inflows to derivatives exchanges, market sentiment is shifting in a bullish direction. In particular, they noted that the gap between the IFP and its 90-day moving average (90MA) is gradually narrowing.

Typically, a so-called “golden cross,” when the two indicators intersect, is interpreted as a medium-term bullish reversal signal. The analyst added that "based on the current indicator trend, that crossover point is drawing closer."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['60% in the red' XRP investors’ burden grows…altcoin market stirs as Bitcoin rebounds [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/5904bda2-2a4b-4397-8c6a-30d2b76ef8c8.webp?w=250)

![Bitcoin on alert for Middle East-driven 'oil price variable'…Ethereum holds $2,000; XRP flashes rebound signal [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/e4b1a9f1-23e3-47f4-ba17-1f4a1a565fd6.webp?w=250)