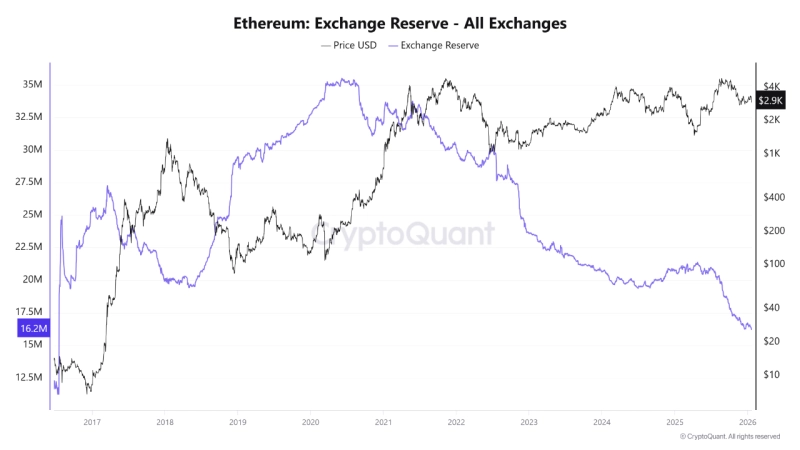

[Analysis] "Ethereum Holdings on Exchanges Hit Lowest Level in 10 Years…Signal of Supply Contraction"

공유하기

Summary

- Ethereum (ETH) holdings on cryptocurrency exchanges fell to around 16.2 million coins, the lowest level since 2016.

- Binance’s Ethereum holdings declined from 4.168 million coins at the start of the year to around 4.0 million, indicating withdrawals are continuing.

- It said the largest exchange’s decline in Ethereum supply increases the likelihood of broader market supply tightness and could have a positive impact on prices over the medium to long term.

Ethereum (ETH) holdings on cryptocurrency exchanges have fallen to their lowest level in the past 10 years, data show.

Arab Chain, a CryptoQuant contributor, said via CryptoQuant on the 21st (local time) that "exchange-held Ethereum has continued to decline, falling to around 16.2 million coins," adding that "this is the lowest level since 2016." Arab Chain noted that "overall Ethereum holdings across exchanges have plunged in tandem with prolonged Ethereum withdrawals," saying it "signals a fundamental shift in investor behavior."

The analysis also cited Ethereum holdings at global crypto exchange Binance. Arab Chain said, "Binance’s Ethereum holdings have fallen from 4.168 million coins at the start of the year to around 4.0 million now," adding that "the downtrend emerged alongside a narrowing gap between Ethereum’s price and holdings." It continued, "This means the pace of Ethereum withdrawals across Binance is being maintained."

The report argues that Ethereum supply could be entering a phase of structural decline. Arab Chain said, "The drop in Ethereum holdings at Binance, the largest exchange, raises the likelihood of supply tightness across the broader market," explaining that "historically, declining exchange balances have often had a positive impact on prices over the medium to long term." It added, "The less sellable supply there is, the more sensitive the market becomes to rising demand," and said that "if an appropriate catalyst emerges, it increases the likelihood of translating into a stronger price move."

![Wall Street focuses on Fed chair nomination and Big Tech earnings…Shanghai stocks enter an earnings-driven market [New York·Shanghai stock outlook]](https://media.bloomingbit.io/PROD/news/b7d7a0aa-abf6-46e4-bbca-4270d970641d.webp?w=250)

![Slips at the threshold of 5,000—will Big Tech, Samsung Electronics and SK Hynix earnings help the KOSPI settle in? [Weekly outlook]](https://media.bloomingbit.io/PROD/news/0959d876-faef-43d8-bc75-8454efc24296.webp?w=250)