Editor's PiCK

KOFIA revamps organization… launches dedicated units for 'K-capital markets and digital assets'

Summary

- The Korea Financial Investment Association said it will establish the K-Capital Markets Division and develop long-term growth strategies for the capital market in preparation for a KOSPI 5,000 era.

- It said it will launch a Digital Strategy Team under the Industry Cooperation Department within the K-Capital Markets Division to support the expansion of businesses related to tokenized securities and virtual asset-related financial products.

- The Korea Financial Investment Association said it plans to support member firms and present a vision for the capital market by establishing a K-Capital Markets Task Force, creating a Real Estate Trust Division, and strengthening external cooperation functions.

The Korea Financial Investment Association (KOFIA) said on the 30th that it has carried out an organizational reshuffle and executive appointments to prepare long-term growth strategies for the capital market in anticipation of a KOSPI 5,000 era, and to strengthen its external cooperation functions—such as legislative support—as well as communication and support for member firms.

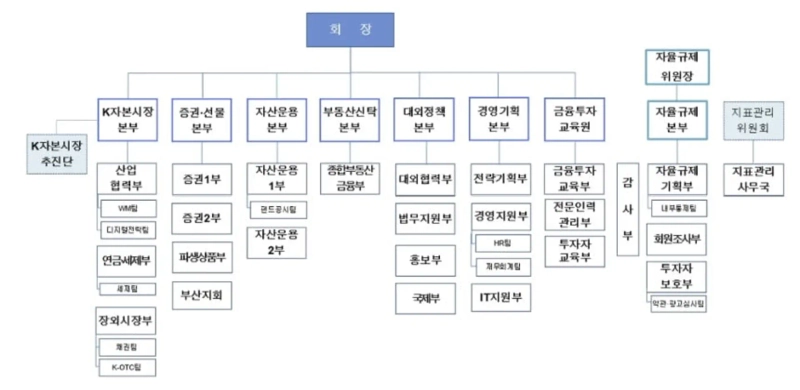

Under the reorganization, the association will shift from its previous structure of “six divisions and an academy, 24 departments, and 15 teams” to “seven divisions and an academy, 25 departments, and 10 teams.”

First, to develop long-term growth strategies for Korea’s capital market, it will establish a “K-Capital Markets Division” that encompasses related departments covering pensions, taxation and digital initiatives.

Within the Industry Cooperation Department under this division, it will set up a “Digital Strategy Team” to support member firms’ expansion of digital-asset businesses, including tokenized securities and financial products related to virtual assets.

To enhance synergies in supporting member firms on pensions and taxation, the Tax Team will be integrated into the Pensions Department to form a combined Pensions and Taxation Department under the K-Capital Markets Division.

Separately from the divisions, it will establish a K-Capital Markets Task Force, focusing on drawing up a blueprint for the next 10 years for K-capital markets and identifying policy agendas.

It will also create a Real Estate Trust Division as an independent division dedicated to supporting real estate trust companies.

In addition, to strengthen external cooperation functions, including legislative support related to the capital market and the financial investment industry, it will elevate the External Cooperation Team and Legal Affairs Team to department level and establish an External Cooperation Department and a Legal Support Department.

To bolster support functions for member firms in the Busan-Ulsan-Gyeongnam region, the Busan branch will be transferred to the Securities and Futures Division.

To improve efficiency through integrated operations within departments, it will abolish the Public Relations Team and Corporate Social Responsibility Team within the Public Relations Department, the Planning Team within the Strategic Planning Department, and the Regulatory Planning Team within the Self-Regulation Planning Department.

KOFIA said, “Through this organizational reshuffle, we plan to present a long-term vision for the capital market and provide more specialized services that can swiftly address the immediate challenges faced by member firms.”

Min-kyung Shin, Hankyung.com reporter radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![Liquidity strains deepen as trading volume contracts and funds exit…Can altcoins rebound? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/5fa259b1-0308-4c7b-9259-04f38ad8fc2a.webp?w=250)