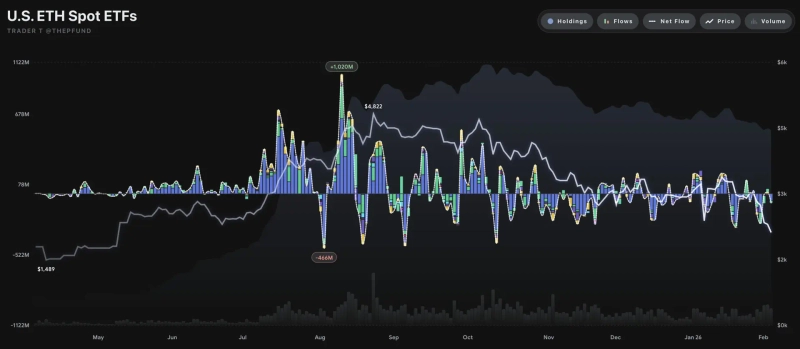

$78.11 million in net outflows from U.S. spot Ethereum ETFs…reflecting weakened risk appetite

YM Lee

Summary

- The report said outflows continued from U.S. spot Ethereum ETFs, signaling a cooling in investor sentiment.

- Trader T said U.S. spot Ethereum ETFs saw $78.11 million in net outflows on the 4th, with BlackRock’s ETHA posting $57.58 million and Fidelity’s FETH $20.53 million in outflows.

- The report said that with net outflows continuing in spot Ethereum ETFs after bitcoin, risk-off sentiment is being seen as holding across the broader digital-asset market.

Outflows continued from U.S. spot Ethereum exchange-traded funds (ETFs), underscoring a cooling in investor sentiment.

According to data compiled by Trader T, U.S. spot Ethereum ETFs recorded net outflows totaling $78.11 million in a single day on the 4th (local time). BlackRock’s ETHA saw the largest withdrawal, with $57.58 million leaving the fund, while Fidelity’s FETH posted $20.53 million in outflows.

By contrast, there were no flow changes in Bitwise’s ETHW, 21Shares’ CETH, Invesco’s QETH, Franklin’s EZET, VanEck’s ETHV, Grayscale’s ETHE, and the Grayscale Mini Trust ETH.

With net outflows persisting in spot Ethereum ETFs following bitcoin, some view risk-off sentiment as holding across the broader digital-asset market.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)