US House lawmaker requests official materials from World Liberty… reviewing ownership structure, transaction records and more

Summary

- The US House of Representatives reportedly requested official materials from World Liberty Financial regarding its ownership structure and the use of stablecoins.

- The House said it demanded documents including the ownership structure and records of investment payments in connection with reports of a UAE-linked investment entity agreeing to acquire a 49% stake for about $500 million.

- The House reportedly demanded materials on USD1, the $2 billion investment transaction, the profit structure, the rationale for token selection, and internal compliance and conflict-of-interest management frameworks.

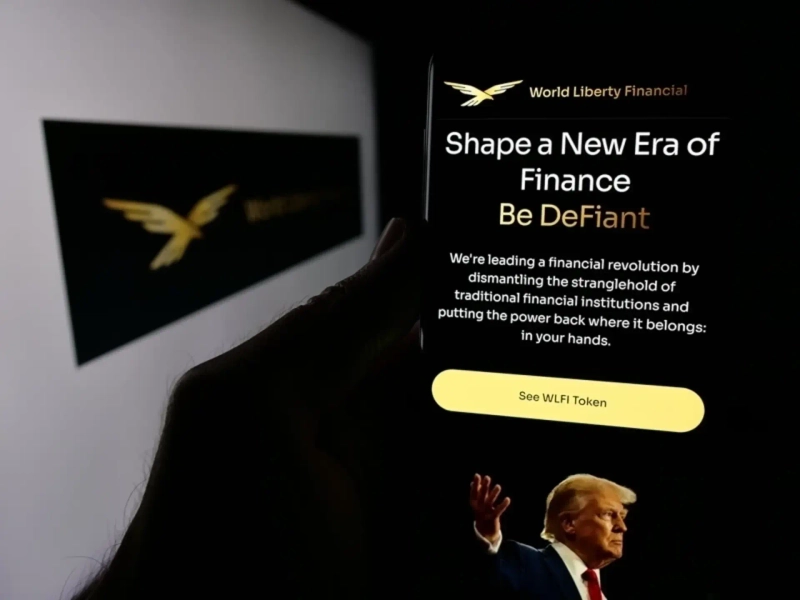

The US House of Representatives has requested official materials from the crypto-asset project World Liberty Financial, linked to former President Donald Trump, seeking to review its ownership structure and the use of stablecoins.

According to CoinDesk on the 5th (local time), House investigative authorities demanded that World Liberty Financial submit documents related to its ownership structure, fund flows and governance. The move followed a Wall Street Journal (WSJ) report that an investment entity linked to the United Arab Emirates (UAE) had taken an equity stake.

The report said an Abu Dhabi-linked investment vehicle agreed in early 2025—just ahead of President Donald Trump’s inauguration—to acquire a 49% stake in World Liberty Financial for about $500 million. The House has requested related materials to verify the facts of the report.

The request was led by Democratic Rep. Ro Khanna, who demanded documents from World Liberty Financial including its ownership structure, records of investment payments, board composition and internal decision-making records. He specifically sought an explanation of the transaction structure with “Aryam Investment 1,” cited as a UAE-linked investment entity.

The House is also focusing on use cases for “USD1,” a dollar-pegged stablecoin issued by World Liberty Financial. USD1 was used as the settlement instrument for a $2 billion investment transaction involving Binance, and the House demanded materials on the profit structure in the transaction process and the rationale for selecting the token.

In addition, the request includes documents on whether World Liberty Financial personnel were involved in discussions before and after the transaction, as well as its internal compliance and conflict-of-interest management framework. House officials also instructed the preservation of relevant electronic records and internal communications.

World Liberty Financial must submit the requested materials by March 1. No official statement from the company has been disclosed so far.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)