Summary

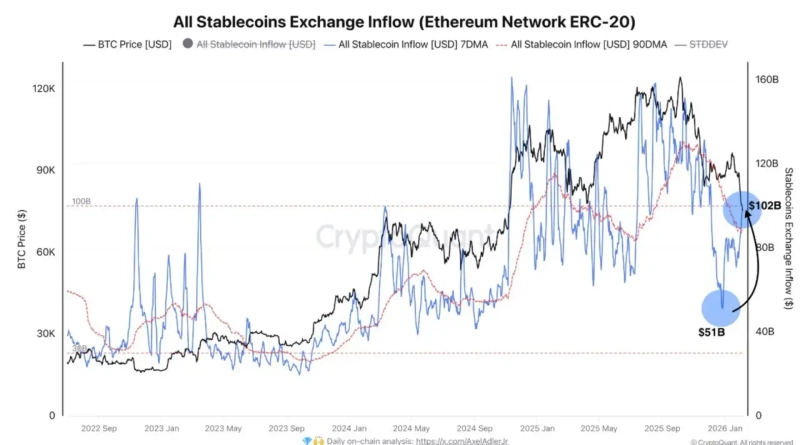

- Average stablecoin inflows to exchanges over the past seven days rose to $102 billion, more than double the level in December last year.

- With the digital-asset market weakening, analysts said investors have moved to buy the dip.

- However, a CryptoQuant analyst said selling pressure remains strong and buying interest is failing to keep up.

Forecast Trend Report by Period

Stablecoin inflows to exchanges—an indicator of liquidity in the digital-asset market—have surged, according to data.

According to digital-asset news outlet Cryptopolitan on the 6th (Korea time), the average stablecoin inflow over the past seven days recorded $102 billion, more than doubling from $51 billion in December last year.

With the digital-asset market under pressure, some analysts say investors have begun buying the dip. CryptoQuant analyst Darkfost said, "Over the past few weeks, the pace of capital inflows into the market has been accelerating," but added that "selling pressure remains strong, and buying interest is failing to keep up."

As of 6:25 p.m. on the day, Bitcoin (BTC) was down 8.42% from the previous day at $65,566. Over the same period, Ethereum (ETH) was plunging 10.89% to trade at $1,901.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Bitcoin rebounds on Nvidia tailwinds…Ethereum selling pressure eases; XRP supply-demand improves [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/6847063a-b1cb-4d71-8466-a89a7bf87567.webp?w=250)