Summary

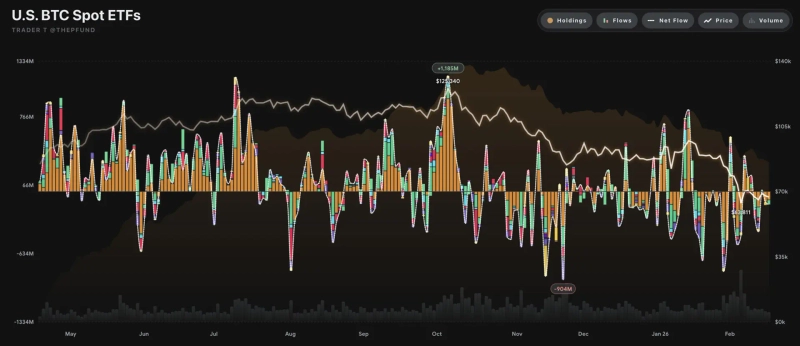

- US spot Bitcoin ETFs saw $134.23 million in net outflows in a single day.

- $85.16 million left BlackRock’s IBIT, while $49.07 million exited Fidelity’s FBTC.

- With Bitcoin moving sideways in the mid-to-high $60,000 range, short-term supply-demand pressure is persisting amid outflows from major ETFs.

US spot Bitcoin (BTC) exchange-traded funds recorded $134.23 million in net outflows in a single day.

According to data compiled by Trader T on the 18th (local time), total net outflows from US spot Bitcoin ETFs came to $134.23 million on the day.

BlackRock’s iShares Bitcoin Trust (IBIT) posted $85.16 million in net outflows. Fidelity’s Wise Origin Bitcoin Fund (FBTC) also saw $49.07 million leave the fund.

By contrast, the Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), Invesco Galaxy Bitcoin ETF (BTCO), Franklin Bitcoin ETF (EZBC), Valkyrie Bitcoin ETF (BRRR), VanEck Bitcoin ETF (HODL), WisdomTree Bitcoin Fund (BTCW) and Grayscale Bitcoin Trust (GBTC) were flat, with neither net inflows nor net outflows.

With Bitcoin trading sideways in the mid-to-high $60,000 range, continued outflows from major large-scale ETFs suggest short-term supply-demand pressures are persisting.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE