PiCK

'Institutional buying continues' Ethereum at a $2,000 inflection point…what would signal a bullish turn? [Kang Min-seung’s Altcoin Now]

Summary

- Bitmine, the world’s largest Ethereum treasury firm, said it is continuing ETH accumulation and an expansion in staking even amid a price correction.

- Experts cited $2,000 as Ethereum’s fair value and a key inflection point, and presented $1,905·$1,880·$1,840 and $2,050·$2,150 as key price levels.

- They said that despite delays in processing the CLARITY Act and extremely bearish sentiment, passage of the bill—along with improving altcoin investor sentiment and a slowdown in Bitcoin dominance—would be conditions for a bullish turn.

Ethereum (ETH) is being viewed as sitting at a critical juncture around the $2,000 level that could determine its next trend, as ongoing institutional accumulation is being offset by rising geopolitical tensions and concerns over delays in processing the CLARITY Act.

Bitmine keeps accumulating Ethereum even in a down market…staking amount also on the rise

As Ethereum continues to fluctuate near its long-term trend support line, major Ethereum treasury firms are maintaining their accumulation stance even during the pullback.

According to the industry on the 20th, Bitmine, the world’s largest Ethereum treasury firm, bought an additional 45,759 ETH last week, lifting its total holdings to 4,371,497 ETH. This corresponds to about 3.62% of total supply. Bitmine is continuing its accumulation strategy with a medium- to long-term goal of securing 5% of total supply.

As of 18:00 on the day, Ethereum was trading around $1,960, below the $2,000 level.

Tom Lee, chairman of Bitmine, said current market sentiment resembles that seen during the 2018 “crypto winter” (a downturn in digital-asset investment) and the November 2022 bear-market bottom.

He said, “Ethereum posted V-shaped rebounds in all eight instances since 2018 when it fell more than 50%,” adding, “This feels like a ‘mini winter.’ We keep buying Ethereum regardless of price action.”

He also stressed, “Network usage metrics are at all-time highs, but price has not fully reflected that.”

On-chain data also show a clear expansion in staking participation. According to Santiment on the 18th, Ethereum staking exceeded 50% on a cumulative issuance basis. The staking queue alone totals 3.8 million ETH.

Still, some in the industry note that the currently active staked amount is estimated at around 30% of total supply. In general, as staking participation expands, circulating supply declines, which is interpreted as a factor that can ease selling pressure.

Meanwhile, while institutions and large holders have moved to take some profits, retail participation is expanding.

“Long-term outperformance potential for Ethereum”…$2,000 is the inflection point

Experts say Ethereum could outperform Bitcoin over the long term, but in the near term, whether it can reclaim $2,000 is the key variable that will determine the next trend.

Cryptocurrency analyst Benjamin Cowen said, “Ethereum’s fair value is estimated at $2,000,” adding, “Ethereum has recently returned home (fair value).”

He explained that there have been periods in the past when price traded about 30% below fair value, and during the pandemic it fell more than 40% below it. He projected that, for the time being, rather than an immediate shift to a strong uptrend, Ethereum is more likely to spend time in this range building a base.

In the short term, whether Ethereum regains $2,000 is seen as a major inflection point. Ashish Jindal, a researcher at NewsBTC, said, “Ethereum is attempting a rebound near $1,905, but if it fails to break through resistance at $1,985 and $2,000, downside pressure could expand again.”

He added, “If it fails to decisively reclaim $2,000, further downside toward $1,880 and $1,840 is possible,” while noting, “Conversely, a break above $2,050 could extend the advance toward $2,150.”

Alex Kuptsikevich, chief analyst at FxPro, said, “Ethereum is positioned above a six-year long-term support line that has been in place since 2020, and that zone overlaps with the area around $2,000.”

He added, “Until there is a clear break below the previous low at $1,500, the long-term trend may remain intact.”

Katie Stockton, founder of Fairlead Strategies, said, “This year could be a period of temporary underperformance for some assets, but that could present a buying opportunity,” adding, “Over the long term, Ethereum could outperform Bitcoin.”

She noted that in many past cases where momentum indicators entered oversold territory, it took several months for a recovery, but said current market sentiment is extremely skewed toward bearishness, which could be a favorable environment for forming a bottom.

She added, “For now, it is reasonable to use Bitcoin as the benchmark asset when assessing altcoin moves.”

Diverging views amid extreme pessimism…what would signal a bullish turn?

As sentiment in the digital-asset market has contracted to levels seen in past downturns, forecasts are diverging over the market’s next direction.

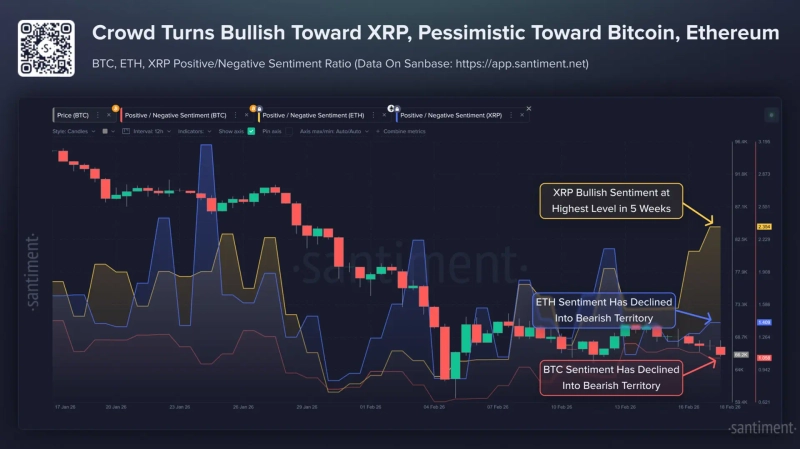

On-chain analytics firm Santiment said, “Optimistic mentions of Bitcoin and Ethereum have declined sharply recently,” adding, “Overall investor sentiment is weakening, except for XRP, which had positive catalysts such as partnerships.”

Analyst Kuptsikevich also said, “The crypto Fear & Greed Index recently fell to 8, and nine of the past two weeks were in single digits,” adding, “That is even more subdued than at the 2020 and 2022 bottoms.”

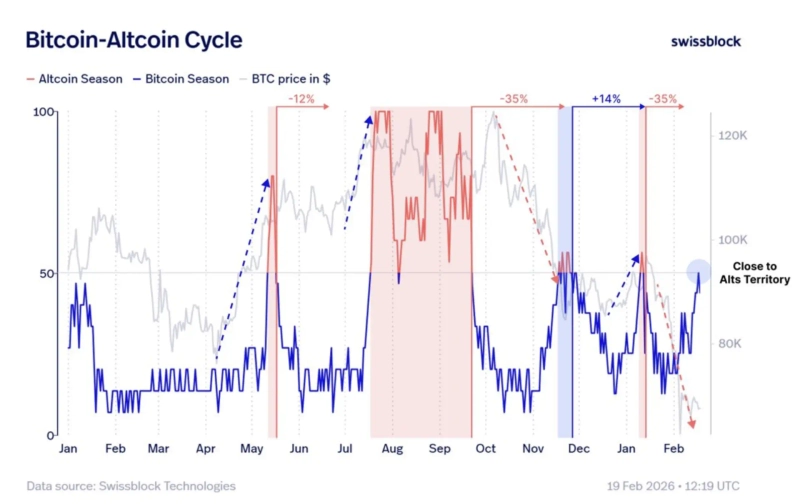

There is also an assessment that the market is showing typical features of a bear phase. Cowen said, “Capital has recently been moving from altcoins to Bitcoin, and then back into traditional assets such as stocks and gold,” pointing to a stepwise decline in risk appetite.

He added, “Given that 2014, 2018, and 2022—U.S. midterm election years—were all bear markets, we cannot rule out the possibility that this year also ends in weakness.”

However, he added, “The market may remain in a corrective flow for a while, and a bottom could form as early as May or as late as October.”

Regulatory uncertainty also persists. Recent White House talks between the digital-asset industry and the banking sector reportedly failed to narrow differences over the payment of yields on stablecoins. As a result, it remains unclear whether the CLARITY Act—a market-structure bill for digital assets—will pass in the first half of the year.

Some observers say that if Congress does not act within the second quarter, momentum for discussions could weaken after August. Others argue that if the bill passes, the improvement in altcoin investor sentiment could be significant.

Amid these mixed signals, market participants still appear to be maintaining a wait-and-see stance. AltcoinVector said, “It is a positive sign that the negative shockwaves (impulse) in altcoins have recently eased,” but added, “The market is still in a zone waiting for a clear trigger.”

It continued, “In the market, early signs of improving altcoin sentiment alone are not enough,” explaining that “only when the deceleration in Bitcoin dominance accompanies it can it be interpreted as a full-fledged bullish turn.”

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Institutional buying continues' Ethereum at a $2,000 inflection point…what would signal a bullish turn? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/ab8df8a2-7167-4dc5-ac49-8b6d1b4c2689.webp?w=250)

![Bitcoin rattled by a ‘split’ at the Fed and Middle East tensions…altcoin sentiment ‘worst’ in five years [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/b82fc76d-8a0a-47e5-ad31-f9312ec445da.webp?w=250)

![[Analysis] “Crypto market sheds $730 billion over past 100 days…investor exodus accelerates”](https://media.bloomingbit.io/PROD/news/75202915-9318-4bfc-b82c-c202e53dd70b.webp?w=250)