PiCK

Bitcoin rattled by a ‘split’ at the Fed and Middle East tensions…altcoin sentiment ‘worst’ in five years [Lee Su-hyun’s Coin Radar]

Summary

- With the Fed’s policy differences and expanding geopolitical risk in the Middle East, Bitcoin has been weak in the $60,000–$65,000 range, with a conservative stance prevailing.

- As US spot Ethereum ETFs posted net outflows for four straight weeks alongside on-chain weakness, downside risk is being raised, with forecasts saying a break of the $2,000 psychological support could open the way to $1,100.

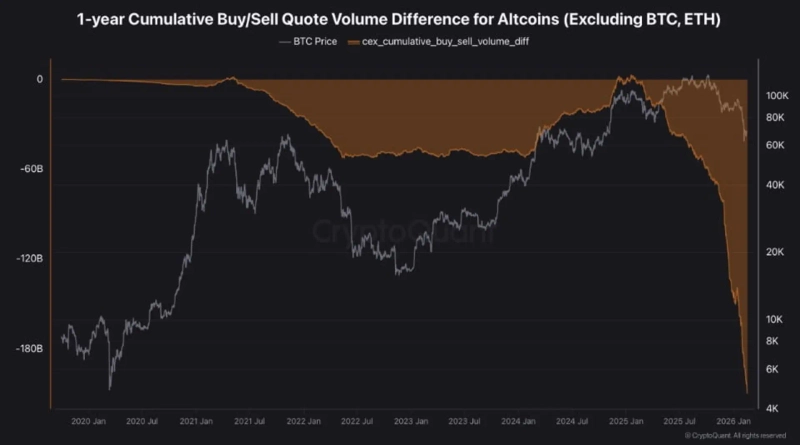

- With cumulative sell pressure in the altcoin market at $209 billion—the worst level since 2021—XRP is trading around $1.4 as worsening sentiment and the potential for further technical downside come into focus.

<Lee Su-hyun’s Coin Radar> is a weekly column that tracks the flow of the digital-asset (crypto) market and explains the backdrop. Going beyond a simple price roundup, it provides a multifaceted analysis of global macro issues and investor positioning, offering insights to help gauge market direction.

Major coins

1. Bitcoin (BTC)

Bitcoin extended its weak tone this week as policy uncertainty and geopolitical risk overlapped. As of the 20th, Bitcoin is trading around $67,000 on CoinMarketCap.

First, the market was shaken after ‘policy differences’ within the US Federal Reserve (Fed) were confirmed in official documents. In the minutes of the FOMC meeting released on the 18th (local time), officials broadly agreed on ‘pausing further rate cuts for the time being,’ but revealed diverging views on the policy path later this year. Alongside the view that additional cuts would be appropriate if inflation falls as expected, there was also the stance that easing would be hard to justify until clearer evidence of disinflation is confirmed.

Some officials also argued the possibility of rate hikes should remain on the table. As expectations for a “pivot to easing within the year” faded, risk assets broadly wobbled. Bitcoin, too, could not avoid the downdraft.

Growing risk aversion driven by geopolitical risk also increased downside pressure. The trigger was the US, with a full-scale war with Iran in mind, concentrating its largest airpower deployment in the Middle East since the 2003 Iraq invasion.

Investment outlet FXEmpire assessed that “after news of heightened US-Iran tensions, funds rapidly rotated into safe-haven assets,” adding that “while gold and silver rose and crude oil (WTI) climbed above $65 a barrel, Bitcoin weakened amid risk-off sentiment.”

On the regulatory front, debate over the US digital-asset market bill known as the CLARITY Act is also acting as a variable.

On the 19th, reports said the White House officially backed a compromise on ‘limited rewards’ for stablecoins. According to crypto outlet CoinDesk, the White House said at a working-level meeting attended by banks and the crypto industry that it would keep certain types of stablecoin reward programs in the next revised draft as well.

Specifically, the proposal would restrict structures that pay “interest simply for holding,” like bank deposits, while allowing rewards tied to specific activities such as payments, transactions, or usage. Given banks’ concerns that stablecoin interest could erode the deposit-based business model, the compromise can be seen as reflecting those worries to some extent.

Still, many variables remain until final passage. Bipartisan agreement is essential for a Senate floor vote. Democrats are raising demands including tougher requirements to sanction illicit actors in DeFi, provisions restricting senior government officials from directly participating in the crypto industry, and disputes over appointments to vacancies at the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), putting them at odds with the White House. If the Senate Banking Committee pushes it through, it could turn into a partisan vote, in which case passage on the Senate floor may not be easy.

In the near term, volatility is likely to persist. Thomas Perfumo, global economist at Kraken, pointed to the $60,000–$65,000 zone as a technical inflection point and suggested the possibility of a rebound. Some, however, are also warning that if the key $60,000 support breaks, losses could extend into the $50,000s. Ultimately, until a clear signal of a recovery in spot demand is confirmed, a conservative stance is assessed to dominate.

2. Ethereum (ETH)

Ethereum also remained sluggish this week as institutional flows softened and on-chain bearish signals surfaced simultaneously. It is currently trading below $2,000 on CoinMarketCap.

As of the 19th, total net outflows from US spot Ethereum ETFs came to $130.51 million. That marked a second straight session of net outflows. The overall outflow was led by BlackRock’s ETHA (a total net outflow of $97.11 million). On a weekly basis, the trend is even more concerning. Spot Ethereum ETFs have posted net outflows for four consecutive weeks, with a total of $165.82 million leaving just last week.

On-chain indicators are also continuing to weigh on prices. Ethereum has failed to recover since falling below its realized price in late January. Trading below that level is interpreted as a signal that most investors are sitting on losses. The market value to realized value (MVRV) ratio has also remained below 1.0, suggesting the potential for further declines.

Typically, when Ethereum trades below the realized price for an extended period, it eventually recovers, but additional downside has often accompanied the process. In addition, about 445,000 ETH (worth roughly $887 million) flowing into exchanges over the past week is also being interpreted as a signal of sell-side preparation, adding to caution.

Still, the foundation is moving to reinforce its long-term roadmap. On the 18th, the Ethereum Foundation unveiled “Protocol Priorities for 2026,” saying it will strengthen Layer 1 centered on three pillars: security, censorship resistance, and network resilience.

It also pushed for stronger quantum resistance and presented a target of raising the gas limit (to 100 million or more), while laying out plans to pursue the Glamssterdam upgrade in the first half and the Hegota upgrade in the second half. However, given that the market is currently more sensitive to price and flows than to technical roadmaps, some say it remains unclear whether the roadmap will translate into a near-term rebound.

Outlooks are mixed. Crypto outlet BeInCrypto viewed $2,000 as a psychological support level, saying that “if selling pressure persists, prices could fall further to $1,866, and below that, the path could open to $1,385.” Conversely, it suggested a rebound to $2,205 could be possible if selling eases and buyers step in.

Coin-focused outlet Cointelegraph noted that “with technical weakness and declining network activity overlapping, the likelihood of further downside has increased,” adding that “if the lower trendline at $1,950 breaks, it could slide to $1,100.”

3. XRP (XRP)

XRP also failed to break above a key resistance level this week and has slipped to the $1.4 area. As of the 20th, it is trading at $1.41 on CoinMarketCap.

The prevailing view is that XRP is being dragged by deteriorating sentiment across altcoins. According to CryptoQuant data, cumulative sell pressure in the altcoin market excluding Ethereum has reached $209 billion, the strongest net-selling level since 2021.

Andrii Pawzan Azimah, head of Bitrue Research, said, “Retail investors have exited en masse and demand from them is lacking,” adding, “With institutions concentrating on large-cap alts such as Bitcoin and Ethereum, the current drop is close to one-sided capitulation by retail.”

Network metrics have also weakened. The number of active XRP addresses fell 26% over the past week to 40,778, and the amount burned via fees dropped by about 75%. This can be interpreted as a signal of shrinking real payment demand and usage.

However, there is also a positive policy development. On the 19th, the Arizona state legislature passed, in the Senate Finance Committee, a bill that includes XRP as an “asset the state government can hold.” If the bill is ultimately enacted, the state government will be able to directly manage or operate digital assets it has seized or come to possess.

The outlook remains cautious. Investment outlet FXEmpire suggested near-term support at $1.1227 and $1.0, with resistance at $1.5, and said that if $1.0 breaks, the short-term downtrend could intensify. Crypto outlet CoinGape flagged $1.50 as a key pivot, noting that a breakout could open a move toward $1.60, but that if it falls below $1.40, additional correction could follow.

Issue coins

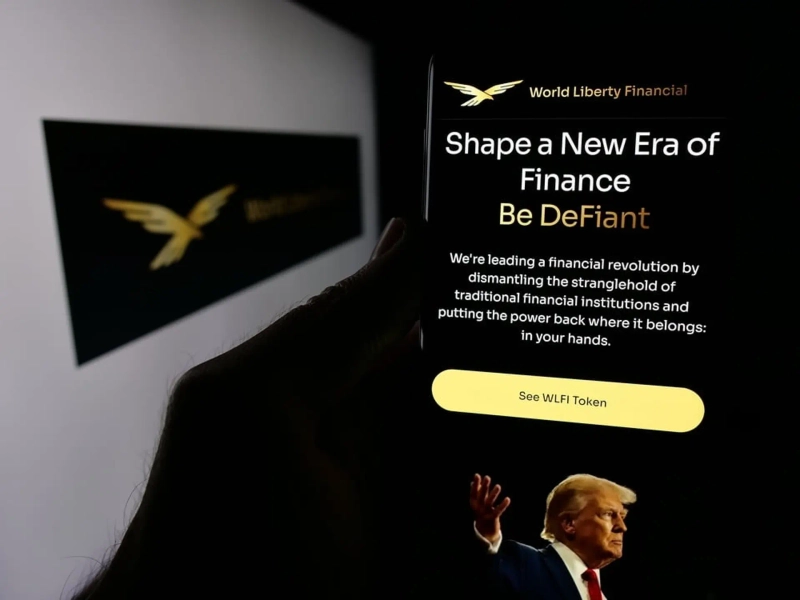

1. World Liberty Financial (WLFI)

With the broader market weak this week, World Liberty Financial drew attention after surging 19% the previous day on its own. However, it has since given back most of the gains and is trading around $0.116 on CoinMarketCap.

The spike is seen as reflecting expectations for bullish announcements tied to the “World Liberty Forum” held in Mar-a-Lago, Florida. Ahead of the event, various announcements related to World Liberty Financial were previewed, and market expectations appear to have been priced in.

In fact, the forum was attended by key figures from global finance, including Goldman Sachs CEO David Solomon, Franklin Templeton CEO Jenny Johnson, NYSE President Lynn Martin, and Nasdaq CEO Adena Friedman. With so many heads of major financial institutions participating, expectations also grew for the project’s potential linkage with the regulated financial system.

World Liberty Financial boosted momentum by officially announcing “World Swap,” a global remittance service based on its USD1 stablecoin. The company claimed it would transform the roughly $7 trillion global remittance market, and the World Liberty Financial token actually rose about 6% immediately after the announcement.

World Swap aims to connect directly with bank accounts worldwide to process FX payments in real time at low fees, and to simplify the remittance process using USD1 to build an efficient settlement structure. It also announced plans to tokenize a share of loan proceeds related to “Trump International Hotel & Resort Maldives.”

Still, some assess that this rise has the character of short-term momentum driven by event expectations. Whether it can sustain an independent uptrend in a weak market, or instead move in tandem with the broader correction, will likely hinge on upcoming price action.

Lee Su-hyun, Bloomingbit reporter shlee@bloomingbit.io

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Institutional buying continues' Ethereum at a $2,000 inflection point…what would signal a bullish turn? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/ab8df8a2-7167-4dc5-ac49-8b6d1b4c2689.webp?w=250)

![Bitcoin rattled by a ‘split’ at the Fed and Middle East tensions…altcoin sentiment ‘worst’ in five years [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/b82fc76d-8a0a-47e5-ad31-f9312ec445da.webp?w=250)

![[Analysis] “Crypto market sheds $730 billion over past 100 days…investor exodus accelerates”](https://media.bloomingbit.io/PROD/news/75202915-9318-4bfc-b82c-c202e53dd70b.webp?w=250)