Summary

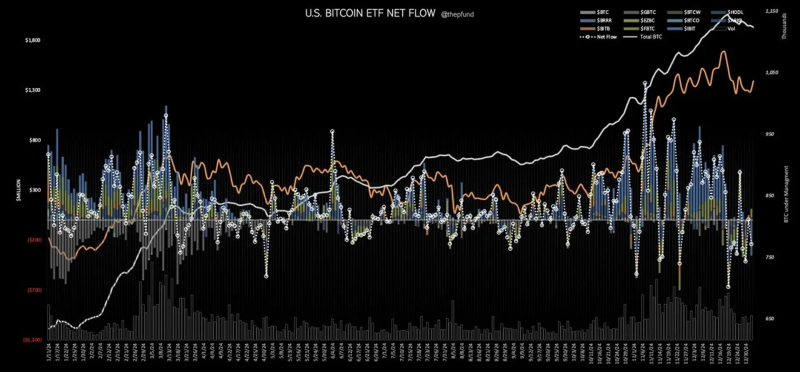

- The US Bitcoin spot ETF has turned to a net outflow in just one day.

- Notably, BlackRock's IBIT recorded the largest net outflow since January.

- Grayscale GBTC also experienced an outflow, but Bitcoin's price rose by 2.1% from the previous day.

The US Bitcoin (BTC) spot ETF has turned to a net outflow in just one day.

According to data from Trader T on the 2nd (local time), $241.4 million was withdrawn from Bitcoin spot ETFs traded in the US. Most products recorded net inflows, but BlackRock's IBIT experienced the largest net outflow ($331.72 million) since its launch in January.

Following BlackRock, Grayscale GBTC also saw an outflow of $23.13 million. Bitwise BITB ($48.31 million), Fidelity FBTC ($36.20 million), and Ark Invest ARKB ($16.54 million) all saw inflows.

Meanwhile, Bitcoin is trading at around $97,000 on the Binance Tether (USDT) market, up 2.1% from the previous day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀