Nasdaq Submits Application to US SEC to Expand BlackRock IBIT Holding Position Limit

Suehyeon Lee

Summary

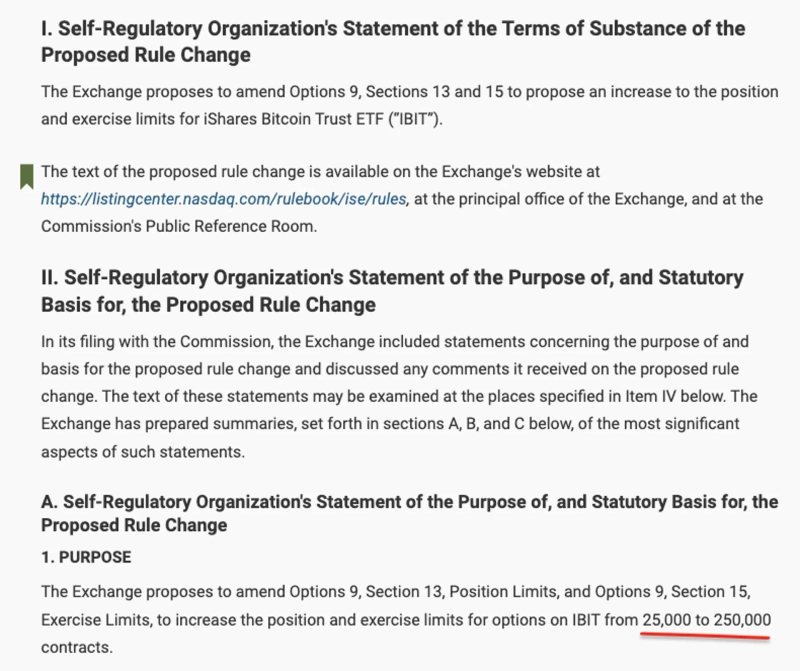

- Nasdaq has reportedly submitted an application to the SEC to increase the holding position limit of BlackRock's Bitcoin spot ETF, IBIT.

- The plan is to expand the holding position limit from the current 25,000 shares to 250,000 shares.

- Jeffrey Park added that considering the increase in IBIT's trading volume, 400,000 shares is the appropriate position limit.

Nasdaq in the United States is moving to expand the holding position limit (the maximum limit of an ETF that an institution or single investor can hold) for BlackRock's Bitcoin (BTC) spot ETF, IBIT.

On the 7th (local time), Jeffrey Park, Bitwise Portfolio Manager and Head of Alpha Strategy, stated on his X (formerly Twitter) that "Nasdaq has submitted an application to the US Securities and Exchange Commission (SEC) to increase the IBIT holding position limit from the current 25,000 shares to 250,000 shares. There will be a review by the SEC on this."

Regarding this, Jeffrey Park added, "Considering the current increase in IBIT's trading volume, 400,000 shares is the appropriate position limit."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)