Summary

- Analysis suggests Bitcoin price may rise as the Max Pain Price is set at $98,000.

- Options sellers have sufficient motivation to increase Bitcoin's spot price ahead of options expiration.

- With the current difference of about $10,000 from the Max Pain Price in the Bitcoin spot market, price appreciation is expected.

As Bitcoin (BTC) February options expiration approaches, analysis suggests that options sellers (mainly institutions) may drive up Bitcoin's spot price to secure larger profits.

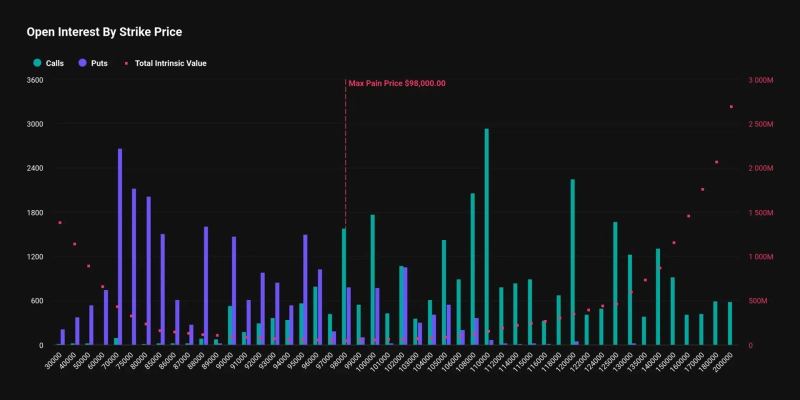

On the 26th (local time), cryptocurrency options exchange PowerTrade stated via X that "according to the Max Pain Price theory, Bitcoin prices could rise" and that "the current Max Pain Price for Bitcoin options is around $98,000."

They added that "February expiry Bitcoin options are worth $5 billion, with most of the Open Interest (OI) concentrated at $98,000" and explained that "options sellers have sufficient reason to push Bitcoin's spot price higher."

The Max Pain Price is the price point at which options buyers suffer the maximum loss while options sellers gain maximum profit at expiration. Given the significant difference (about $10,000) between Bitcoin's current Max Pain Price and spot price, the explanation suggests that options sellers might intentionally drive up Bitcoin's price to secure larger profits.

As of 11:58 PM, Bitcoin is trading at $87,469 on Binance's USDT market, up 0.35% over the past 24 hours.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit