Editor's PiCK

Solana Loses Trust, Halved in 6 Weeks... Will the Downtrend Continue?

Summary

- Solana is likely to continue its downtrend due to declining trust and upcoming token unlocks, according to reports.

- A large-scale unlock of 11.2 million SOL is scheduled for March 1, which could put additional downward pressure on the market.

- However, Solana's technical capabilities and the possibility of spot ETF approval could serve as positive factors, leaving room for a potential rebound.

Solana Records 5-Month Low

Deteriorating On-Chain Data and Token Unlocks Among Negative Factors

"Downtrend and Sideways Movement Expected to Continue for Now"

Solana, which reached an all-time high of $259.63 on Binance on January 19, has now hit a 6-month low of $125.55. In just 6 weeks, it has fallen to about half of its peak value. Considering Solana's current situation, some analysts predict the possibility of further decline.

As of 6:30 PM on the 28th, Solana is trading at around $132 on Binance's USDT market, down 6% from 24 hours ago. This represents a 49% decrease from its all-time high and a 26% drop compared to a week ago.

The decline was even steeper on the domestic exchange Upbit. As of 6:30 PM, Solana was trading at around 197,000 won on Upbit, a massive 57% drop from its peak of 454,500 won.

The main cause of Solana's decline is attributed to the loss of ecosystem trust following meme coin controversies. Kim Dong-hyuk, an analyst at Dispread, told Blooming Bit, "Solana's credibility has been damaged by rumors connecting the Libra meme coin incident with Solana-based decentralized exchanges (DEXs) Jupiter (JUP) and Meteora (MET)," adding, "Evidence suggesting Bybit hackers laundered funds through Solana-based meme coins likely had a negative impact as well." He explained that the declining market trust in Solana is causing a contraction across the entire Solana ecosystem.

Previously, Galaxy Research also stated in a report that "Solana's rise has been driven by meme coin demand" and predicted that "controversies surrounding Libra and others could reduce market participants' investment sentiment toward Solana."

Negative On-Chain Data... Downtrend Expected

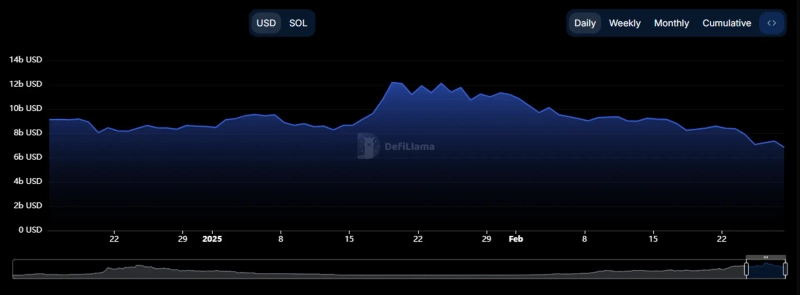

Solana's loss of trust is also evident in its overall on-chain data. According to DeFiLlama, Solana's Total Value Locked (TVL) reached an all-time high of $12.1 billion in January but has since fallen to $6.8 billion as of the 28th. This represents the largest monthly decline since the FTX collapse.

Solana network activity has also significantly decreased. Crypto analyst Ali Martinez noted, "Solana network activity has dropped 60% from its all-time high in October last year," pointing out that the number of active Solana addresses has drastically decreased from 18.5 million in October last year to 7.3 million. He added, "Solana's transaction volume has plummeted from $1.99 billion in November last year to $14.57 million." Trading volume on Solana-based DEXs is also declining. The trading volume of Solana-based DEXs has decreased by about 30% over the past 7 days, reaching its lowest level since October last year.

This has led to a reduction in Solana's fee burn rate. Fee burning increases the scarcity of a cryptocurrency, positively affecting its price. Crypto analyst Miles Deutscher analyzed, "Investors are tired of losing money at the casino and are leaving the table," adding, "Solana's fee burn rate is at its lowest level in a month."

Additionally, the upcoming Solana token unlock related to the FTX recovery trust could act as another negative factor. According to Messari, 11.2 million SOL are scheduled to be unlocked on March 1 (local time).

Kim Dong-hyuk, an analyst at Dispread, stated, "Due to the deterioration of trust in Solana, on-chain indicators such as TVL and the number of active addresses are decreasing," and "After the large-scale unlock scheduled for March 1, the market supply of Solana may increase as the FTX recovery trust secures cash, which could act as an additional factor for price decline." He further predicted, "Due to various factors including on-chain indicators and large-scale unlocks related to FTX, Solana is likely to continue its downtrend and sideways movement for the time being."

Crypto analyst RunnerXBT said, "This is a risky time to invest in Solana," adding, "The March 1 unlock is the single largest in scale and will be the biggest FUD (Fear, Uncertainty, Doubt) since the FTX collapse."

"Strengths Remain... Positive if Spot ETF is Approved"

However, some offer positive outlooks. They argue that Solana still possesses excellent technology.

Kim Gyu-jin, CEO of Tiger Research, stated, "While there are concerns that Solana is becoming a platform where speculative trading is concentrated, this actually proves its technical capability to process large-scale transactions stably," adding, "Its strengths of high transactions per second (TPS) and low fees still remain." He further predicted that Solana could show positive momentum in the future, noting that the possibility of a Solana spot ETF approval has increased due to changes in the SEC's policy stance.

Brian, a Santiment analyst, said, "The current market sentiment toward Solana is very negative," but added, "Since prices tend to move in the opposite direction of market sentiment, a short-term rebound is expected." He emphasized, "The Solana development team continues to make progress," and "from a long-term perspective, Solana could eventually rise."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit