Summary

- Cobesie Letter reported that Bitcoin is not being recognized as a safe-haven asset, which could lead to further decline.

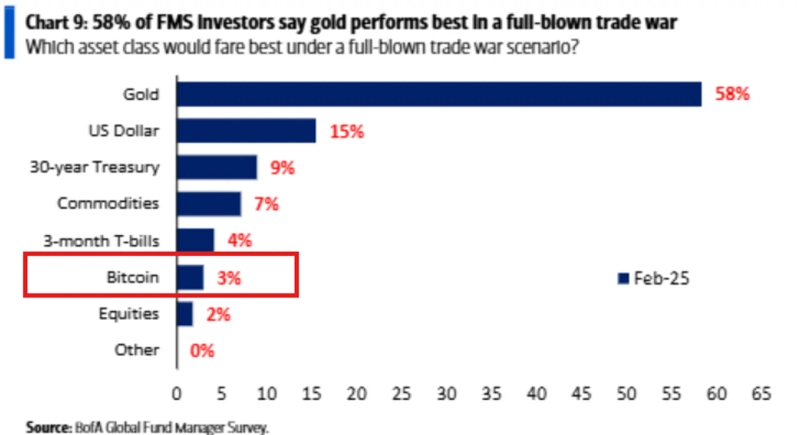

- Citing a Bank of America survey, they suggested the possibility of further decline for Bitcoin.

- According to the survey, only 3% of respondents expected Bitcoin to show positive growth during the trade war.

An analysis suggests that Bitcoin (BTC) could experience further decline due to the tariff war.

On the 3rd (local time), Kobeissi Letter stated through X that "Bitcoin is not being recognized as a safe-haven asset" and added that "while gold has risen 10% since January 1, Bitcoin has fallen 10%."

They then shared a Bank of America survey, suggesting the possibility of further Bitcoin decline. Kobeissi Letter said, "The survey shows investors' perspective on Bitcoin's rise" and added that "the market will not view Bitcoin as a hedge against uncertainty."

According to the survey, 42% of respondents rated the global tariff trade war as the most pessimistic event for risky assets. Additionally, only 3% of respondents expected Bitcoin to show positive growth during the trade war. Investors predicting strength in gold and the dollar were at 58% and 15% respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)