Editor's PiCK

[Analysis] "Bitcoin (BTC) Short-term Investors Show Panic Selling and Profit-taking... Long-term Investors Hold On"

Summary

- It was reported that Bitcoin's short-term investors have increased selling pressure through recent panic selling and profit-taking.

- In contrast, long-term investors who have held for more than 6 months are maintaining their holdings and not showing aggressive selling pressure.

- The analysis forecasts a potential decrease in supply in the long term, with additional price increases possible if sufficient demand flows in.

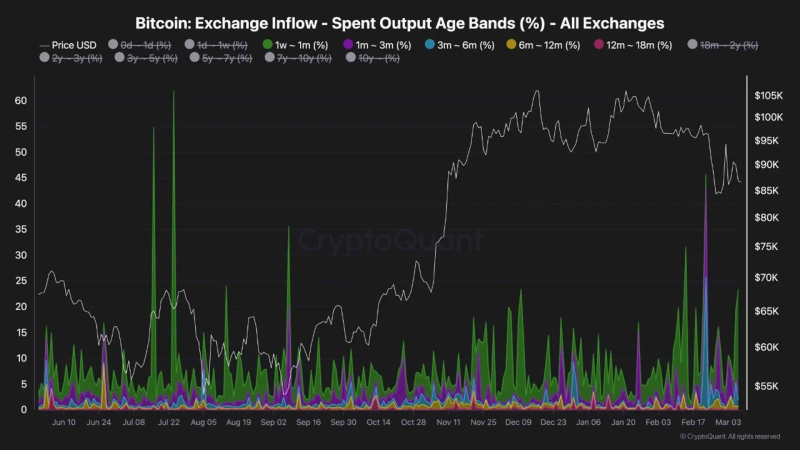

Recent analysis shows that while selling pressure has increased due to panic selling and profit-taking by short-term investors during the recent correction, long-term investors are holding their positions and weathering the storm.

On the 8th, Shayan (ShayanBTC), an analyst at the cryptocurrency analysis platform CryptoQuant, stated through a QuickTake report, "Selling pressure from short-term investors is identified as the main cause of the recent correction. Their panic selling and profit-taking are analyzed to have fueled the price decline."

The analyst noted, "In contrast, long-term investors who have held for more than 6 months are not showing aggressive selling pressure," adding, "Long-term investors are maintaining their holdings in expectation of higher prices, and there is a possibility that the circulating supply in the market will decrease in the short term."

He also added, "This is a characteristic typically seen in a healthy bull market," and "If sufficient demand flows in, the decrease in supply could promote additional price increases."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.