Editor's PiCK

[Today's Globally Trending Coins] AIXBT, Solana, Ethereum & More

Summary

- AIXBT has attracted investors' attention with a recent price drop of about 8%, and some investors are expecting a potential price rebound, according to the report.

- Solana is gaining attention from investors for a proposal to adjust token issuance based on staking participation rates, which could reduce inflation by up to 80% if successful.

- Ethereum has seen increased online mentions as whales continue accumulation, with $500 million worth of Ethereum withdrawn from major exchanges, according to the report.

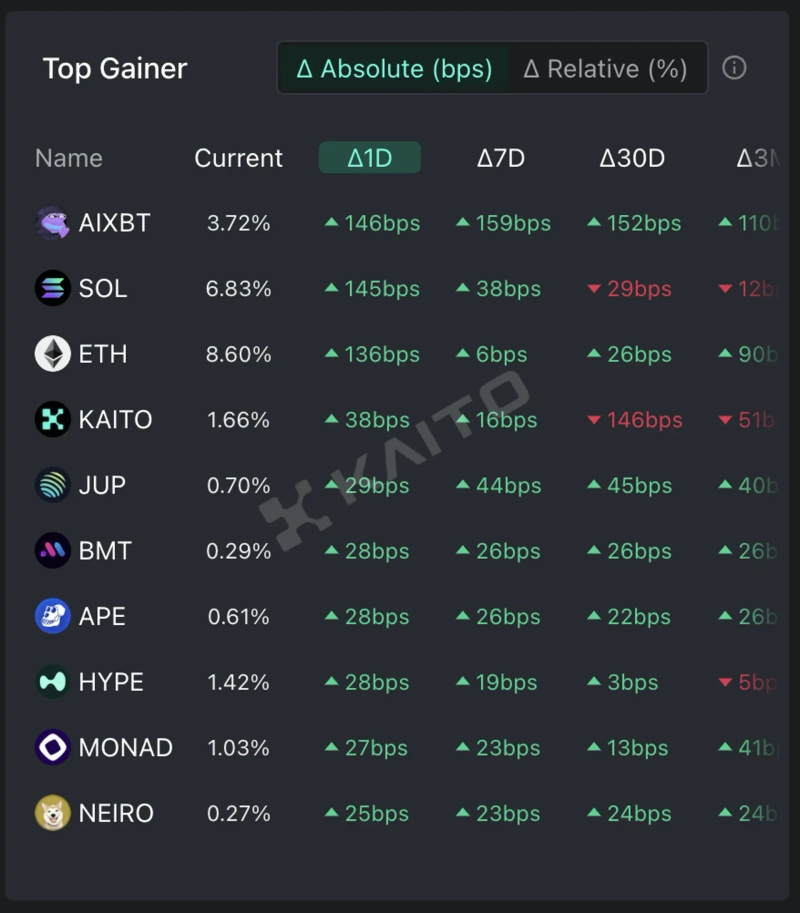

According to Token Mindshare's top gainers from Kaito, an AI-based Web3 search platform (Token Mindshare is a metric that quantifies the influence of specific tokens in the virtual asset market), the top 5 virtual asset-related keywords that people are showing the most interest in as of the 9th are AIXBT, Solana (SOL), Ethereum (ETH), Kaito (KAITO), and Jupiter (JUP).

AIXBT is presumed to have caught investors' attention due to its recent price decline. As an AI agent sector token, AIXBT is trading at around $0.12 on CoinMarketCap as of today, down about 8% from the previous day. Compared to a week ago, it has fallen by more than 38%. However, some investors are expecting AIXBT's price to potentially rebound soon.

Solana has gained attention as voting recently began on adjusting its token issuance. The Solana community started voting on the 'SIMD-0228' proposal yesterday (8th), which would adjust token issuance based on investor staking participation rates. SIMD-0228 proposes reducing Solana token issuance when staking participation increases and increasing issuance when participation decreases. Solanafloor stated, "If the proposal passes, inflation could decrease by up to 80%."

Ethereum's online mentions have increased, likely due to continued accumulation by whales (large investors). According to on-chain analysis platform Santiment, as of yesterday (8th), whales have accumulated a total of 1.1 million Ethereum over the past 48 hours. On-chain analysis platform IntoTheBlock noted, "This week alone, $500 million (approximately 720 billion won) worth of Ethereum was withdrawn from exchanges," adding that "this shows Ethereum traders are continuing large-scale accumulation."

Kaito recently stirred controversy over allegations of large-scale token sales by the Kaito team. The allegation claims that the Kaito team sold approximately 2 million tokens about 2 hours before Kaito was listed on the domestic virtual asset exchange Upbit. These tokens are worth about $4.1 million (approximately 6 billion won). Regarding this, Kaito explained, "The volume in question was loan volume from market makers (MM)" and that it was "a previously scheduled event." As of 1:59 PM today, Kaito is trading at $1.62 on CoinMarketCap, up 2.27% from the previous day.

Jupiter drew attention by announcing plans to revamp its authentication system. Jupiter announced through its official X (formerly Twitter) account today, "A new authentication system will soon be introduced to the data framework we've built." Jupiter added, "Community participation will play a key role in the search and authentication process," and that "detailed information will be disclosed soon." Jupiter also refuted recent allegations of token sales. Jupiter co-founder Meow stated yesterday (8th) via X, "We have never sold Jupiter for operational funds," adding that "all (Jupiter) team members receive their salaries and bonuses in cash."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul