Editor's PiCK

Trump Ignores Recession Warnings?... Bitcoin Investors in 'Extreme Fear' [Kang Min-seung's Trade Now]

Summary

- Bitcoin could continue its upward trend if it breaks through $84,000, but further decline is expected if the $80,000 support level breaks, according to analysts.

- Donald Trump's tariff policy uncertainty is increasing volatility in global stock markets and cryptocurrency markets, with investors' concerns about economic recession persisting.

- Selling pressure from short-term investors in the cryptocurrency market continues, and whether long-term investors can withstand the current correction will be a crucial variable.

"Bitcoin will continue to rebound if it stably breaks through 84k"

"Be cautious of expanded decline if it falls below 80k support line"

Bitcoin (BTC, Bitcoin), which plummeted after U.S. President Donald Trump indicated his intention to maintain comprehensive tariff policies, is partially recovering its recent losses as bargain hunting flows in.

Market experts suggest that Bitcoin is likely to continue its recovery if it stably breaks through $84,000, but if it falls below the $80,000 support line, the decline could be more significant.

As of 7:43 PM (Korean time) on the 12th, Bitcoin is trading at 122.02 million won on Upbit's KRW market, down 0.65% from the previous day (equivalent to $82,160 on Binance's USDT market). At the same time, the Kimchi premium (price difference between foreign and domestic exchanges) has slightly increased to 2.42%.

"Financial markets fluctuate amid recession fears... tariff policy uncertainty amplifies"

Global stock markets and cryptocurrency markets recently plunged together after President Trump stated he could accept a recession resulting from tariff impositions. Kevin Hassett, Chairman of the White House National Economic Council (NEC), attempted to defuse the situation by saying tariff uncertainties would be resolved after April, but recession fears have not subsided. Investors are expressing fatigue over the fluctuating tariff policies.

In a Fox News interview released on the 10th (local time), when asked about the possibility of a recession this year, President Trump said, "There is a transition period (until the effects of tariffs appear)" and "What we're doing is bringing wealth back to America, which takes a little time." The market interpreted Trump's remarks as being willing to accept the possibility of a short-term recession or stock market decline. The 25% tariff on steel and aluminum, which signals the start of a 'tariff war,' is set to take effect on the 12th (local time).

Market participants are closely watching the U.S. Consumer Price Index (CPI) for February, to be released at 9:30 PM Korean time (8:30 AM local time). If consumer prices come in higher than expected amid intensifying stagflation (low growth, high inflation) concerns, the overall financial market could face another shock. Some argue that President Trump is deliberately allowing the stock market to fall to induce lower Treasury yields.

Meanwhile, the Chicago Mercantile Exchange (CME) FedWatch indicates a 97% probability that the Fed will keep interest rates unchanged in March, as of 7 PM today. June is likely for the first rate cut, with a 55.4% probability.

"Bitcoin experiences panic selling and increased volatility... investor sentiment in 'extreme fear'"

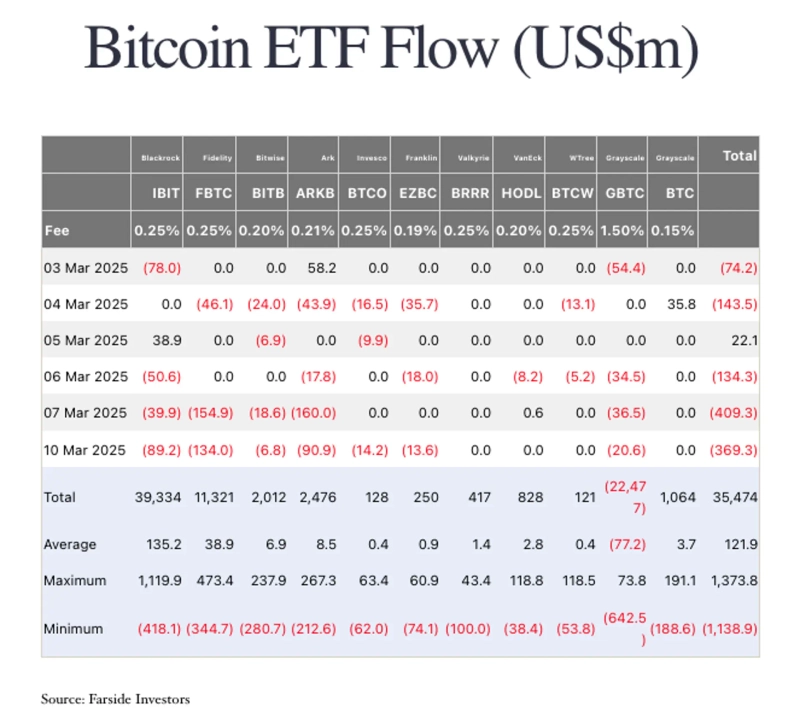

Bitcoin spot Exchange-Traded Funds (ETFs) saw net outflows of $739.2 million (approximately 1.0733 trillion won) last week (March 3-7). Last week, U.S. President Trump signed an executive order to stockpile Bitcoin as a strategic asset, but institutional investors continued selling due to disappointment after he ruled out additional purchases. Observations suggest that the White House cryptocurrency summit also fell short of market expectations.

Global cryptocurrency exchange Bitfinex analyzed in a research report, "Bitcoin temporarily surged last week on expectations for the U.S. strategic Bitcoin reserve and the White House cryptocurrency summit, but quickly gave up its gains due to 'buy the rumor, sell the news' selling pressure." According to Bitfinex, realized losses by investors increased to an average of $818 million (approximately 1.1865 trillion won) per day last week.

The report stated, "Widespread panic selling (like recently) could be interpreted as a sign of market stabilization," but added, "Current macroeconomic indicators are not providing clear direction, and uncertainty is increasing." It further predicted, "If the current market maintains its bullish structure, buying interest is likely to flow in at these levels."

Analysts also note that market participants have turned cautious as short-term investors have engaged in massive selling. On-chain analysis platform Glassnode diagnosed in its weekly research report, "Cryptocurrency market liquidity has been decreasing since the end of last month, and investment sentiment has rapidly contracted due to the Bybit hack and the impact of Trump's tariff war." It further analyzed, "Strong selling pressure continues as short-term investors who bought at relatively high prices are capitulating (mass selling)."

The report stated, "The current market situation is similar to when Bitcoin crashed to $49,000 in August last year," but added, "In this decline, active bargain hunting is not appearing. Investors are showing cautious observation." It also noted, "The market has shifted from accumulation to distribution phase, with short-term selling fatigue building up. There may soon be buying opportunities for long-term investors."

Fear sentiment is being reflected more strongly in the cryptocurrency market. Cryptocurrency newsletter Asymmetric analyzed, "Despite a series of positive news in the cryptocurrency industry over the past few weeks, such as the dismissal of the Binance lawsuit, cryptocurrency market sentiment has contracted even more than during the 2022 FTX collapse crisis. It showed extreme fear levels."

Asymmetric stated, "The recent decline is not simply a cryptocurrency industry problem," adding, "Risk-off sentiment has spread as risk assets in traditional financial markets have been heavily sold. Cryptocurrencies, being inherently high-beta assets (more volatile than market average), tend to fall in tandem with risk asset declines."

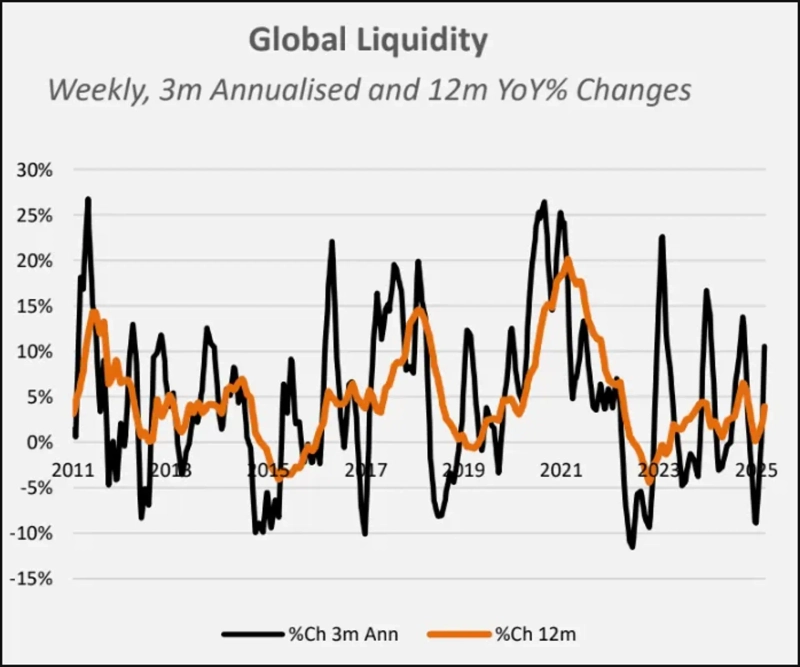

It continued, "Global liquidity is increasing again," adding, "Volatility has returned to the cryptocurrency market. Increased liquidity and expanding volatility could lead to buying opportunities."

"Will Bitcoin defend the key support line of $80,000?... at a trend crossroads"

Market experts predict that Bitcoin is likely to continue its recovery if it stably breaks through the major resistance around $84,000, but if the support line near $80,000 collapses, a larger decline is expected.

Bitcoin is attempting to rebound, partially recovering recent losses. Ayush Jindal, a NewsBTC researcher, analyzed, "Bitcoin is attempting to rebound after testing the $76,500 support line, partially recovering recent losses," adding, "Short-term resistance to the rise is formed around $83,200, with key resistance around $84,000." He also predicted, "If Bitcoin clearly breaks through and settles above the $85,000 resistance, it could rise to $86,500, $88,000, and further to $96,200 in sequence."

However, concerns are raised that if Bitcoin falls below $80,000, the decline could intensify. The analyst analyzed, "If Bitcoin fails to break through the $84,000 resistance, it is likely to fall further," adding, "The short-term support line is estimated at $81,200, with major support at $80,000." He explained that if Bitcoin falls further, it is likely to decline to $78,000, $76,500, and $75,000.

There are also analyses that downward pressure on Bitcoin is increasing after breaking out of the lower end of the box range. Katie Stockton, founder of Fairlead Strategies and a famous market analyst, diagnosed, "Recently, Bitcoin broke below the box range that had been maintained for 3-4 months," adding, "In the medium term, this could be interpreted as a correction phase where additional purchases can be made. However, I think it's advisable to wait and see for now."

Stockton analyzed, "Considerable bearish sentiment has spread throughout the stock market, affecting all risk assets," adding, "Bitcoin has shown a steep upward trend this year, but the pace of increase may slow down or move sideways within a certain price range for the time being. This is in line with the expected movement in the stock market." She advised, "As the U.S. stock market is likely to fall further, investors should consider defensive and conservative strategies."

The possibility that Bitcoin's long-term upward trend could be tested was also raised. Stockton said, "Bitcoin is still in a long-term upward trend, but there is a high possibility of correction due to overbought conditions this month, and there is also a risk that the long-term upward trend could be shaken," adding, "For the time being, the market may show unfavorable flows for investors. Ultimately, whether long-term investors can withstand this correction will be the key."

Alex Kuptsikevich, FxPro's chief market analyst, also diagnosed, "The recent cryptocurrency market fell due to the sharp drop in the U.S. stock market," adding, "As traditional financial institutions' influence strengthens in the cryptocurrency market, the coupling (correlation) phenomenon with the stock market is intensifying." The total cryptocurrency market capitalization fell below $2.5 trillion on the 11th, retreating to early last year's level. However, there are also evaluations that market fear is less compared to past corrections of similar magnitude.

The analyst predicted, "Bitcoin retreated to $76,500 recently and successfully rebounded above $80,000," but added, "In the short term, there is a high possibility that additional corrections will continue to the $70,000-$74,000 range. Bearish patterns continue based on the daily chart, increasing the possibility of further declines."

He added, "The results of the White House cryptocurrency summit last week did not significantly deviate from expectations and were not at a level to directly shock the market, but some market participants are showing movements to highlight uncertainty by interpreting it negatively."

Kang Min-seung, BloomingBit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.