Editor's PiCK

"Trump Administration, Stablecoin Bill is 'Top Priority'...Opportunity for Ripple?" [Kang Min-seung's Altcoin Now]

Summary

- The Trump administration has made stablecoin legislation a top priority, which could potentially benefit US-based stablecoin issuers like Ripple, according to reports.

- Trump's policies might maintain Bitcoin reserves and reduce long-term selling pressure, according to a report by Kaiko.

- Due to decreasing trading volume and increasing volatility in the overall cryptocurrency market, a solid rebound in the altcoin market appears difficult in the short term, suggesting investors need patience.

White House Signals Stablecoin Utilization at Cryptocurrency Summit

"Ripple and Other US Stablecoin Issuers Could Be Major Beneficiaries"

'Blue Chip' Altcoins Also Show Mid to Long-term Growth Potential

Overall Cryptocurrency Market Continues to See Declining Trading Volume

Solid Rebound Remains to Be Seen

Despite institutional support such as the stablecoin bill, the virtual asset (cryptocurrency) market is struggling to find opportunities for a rebound as uncertainty grows over Trump's tariff policies. Market experts noted that overall cryptocurrency trading volume is decreasing and investor sentiment is deteriorating, leading to increased uncertainty.

Following Bitcoin's recent weakness, the altcoin market has shown a clear downward trend. Ethereum (ETH), the leading altcoin, was trading at $1,931 (2,837,000 KRW on Upbit) as of 3:03 PM on the 16th on Binance's USDT market, up 0.26% from the previous day. The relative value of Ethereum to Bitcoin (ETH/BTC) has continued its downward trend for three consecutive weeks.

Today, Bitcoin (BTC) dominance (the proportion of Bitcoin in the total market capitalization of cryptocurrencies) remains at 61.68%, the highest level this year. While Bitcoin is relatively defending against downward pressure, the altcoin market continues to see capital outflows.

"Stablecoin Bill is Top Priority"...What's Behind the Trump Administration's Thinking?

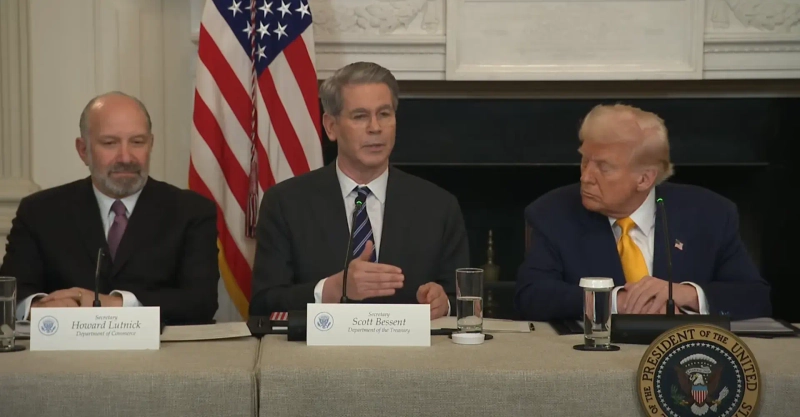

The key agenda at the recent White House cryptocurrency summit was not the Bitcoin strategic reserve plan, but rather the stablecoin-related bill. President Donald Trump strongly urged the swift passage of the stablecoin bill at this meeting. The Trump administration believes that the introduction of this bill could further solidify the global dominance of the US dollar while also helping to lower US market interest rates.

The stablecoin bill has emerged as a top priority in the US cryptocurrency regulatory landscape. On the 8th, President Trump stated at the White House Crypto Summit, "I hope that the stablecoin bill will pass in Congress before the August recess so that I can sign it." US Treasury Secretary Scott Bessent also emphasized, "We will ensure that the US maintains its position as the world's dominant reserve currency, and we will utilize stablecoins to achieve this." The stablecoin bill (GENIUS Act) recently passed the US Senate Banking Committee and is awaiting a full Senate vote.

There are also analyses suggesting that the Trump administration is exploring ways to alleviate its massive fiscal deficit through stablecoins. As of the 28th of last month, US national debt stands at approximately $36.22 trillion (about 5,265.4 trillion KRW). According to the Congressional Budget Office (CBO), the federal government's annual interest burden is projected to reach $952 billion (about 1,383 trillion KRW). The Wall Street Journal (WSJ) observed that "stablecoins will become the biggest customers buying US government debt instruments" and that "stablecoins could be one way to prevent a US debt crisis."

President Trump has previously emphasized the need to lower US market interest rates. Generally, when Treasury yields fall, the interest burden that the US government must pay also decreases. When issuing additional Treasury bonds, they can be sold at higher prices. If the stablecoin bill passes, stablecoin issuers will be required to hold US Treasury bonds. As a result, increased demand for Treasury bonds is likely to lead to lower bond yields (and higher Treasury prices). A recent US Treasury Department research report analyzed that "as stablecoins grow, there has been some increase in demand for short-term Treasury bonds."

Stablecoin issuers are indeed becoming major buyers of US Treasury bonds. On the 11th (local time), Paolo Ardoino, CEO of Tether (USDT), said, "Tether, as the world's largest stablecoin issuer, includes US Treasury bonds among its main reserve assets. Through this, Tether is contributing to the stability of US Treasury bonds." US economic publication Forbes analyzed that "stablecoin issuers hold more than $150 billion in US Treasury bonds and are serving as a major source of funding for the US government."

Typically, stablecoins use collateral to maintain their value, and US Treasury bonds are often used as collateral. The top five stablecoin issuers held a total of $125 billion in US short-term Treasury bonds as of September last year. This is similar to the amount of US Treasury bonds held by South Korea.

"Stablecoin Market to Exceed 720 Trillion KRW Next Year...What Impact Will This Have on Altcoin Investment?"

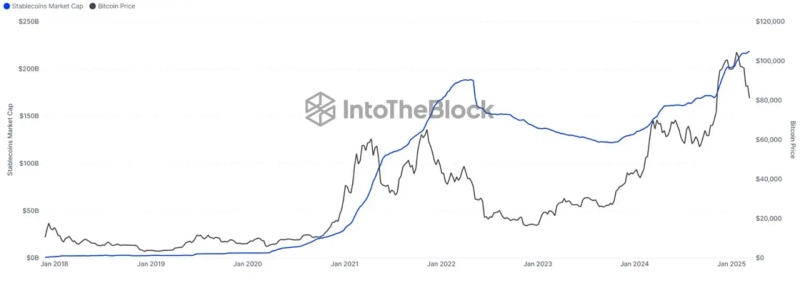

The industry expects the stablecoin market to continue its rapid growth. US asset management firm Bernstein analyzed that "the stablecoin market size will reach $500 billion (approximately 727.25 trillion KRW) by 2026" and that "half of the world's banks are likely to provide stablecoin-related services." Today, the total market capitalization of all stablecoins stands at approximately $229.17 billion (about 333.0985 trillion KRW).

Typically, an increase in the issuance and circulation of stablecoins indicates an expansion of capital inflow into the virtual asset market. This can act as buying pressure in the market and is considered a bullish signal.

There are also suggestions that Ripple and other US-based stablecoin issuers could be major beneficiaries. Cryptocurrency media outlet Crypto News predicted that "the high standards of the GENIUS Act could act as a barrier to entry for foreign stablecoin issuers" and that "this would provide a competitive advantage to US-based companies such as Circle, the issuer of USD Coin (USDC), and Ripple, the issuer of RippleUSD (RLUSD)." The GENIUS Act, which currently enjoys bipartisan support, imposes stricter reserve requirements, liquidity requirements, and compliance requirements on stablecoin issuers. In particular, it includes provisions that strengthen standards for foreign issuers.

US economic publication Business Insider reported, "If Congress passes the stablecoin bill, institutional investors are likely to enter the market in earnest" and that "banks have been unable to enter the stablecoin market due to regulatory uncertainty, but if the bill passes, large-scale funds could flow in." There are also predictions that as institutional investor participation increases, 'blue chip' altcoins such as Solana (SOL), Cardano (ADA), and XRP, which attract institutional interest, could accelerate their growth in the mid to long term.

"Declining Trading Volume in Altcoin Market...Deteriorating Investor Sentiment and Intensifying Volatility"

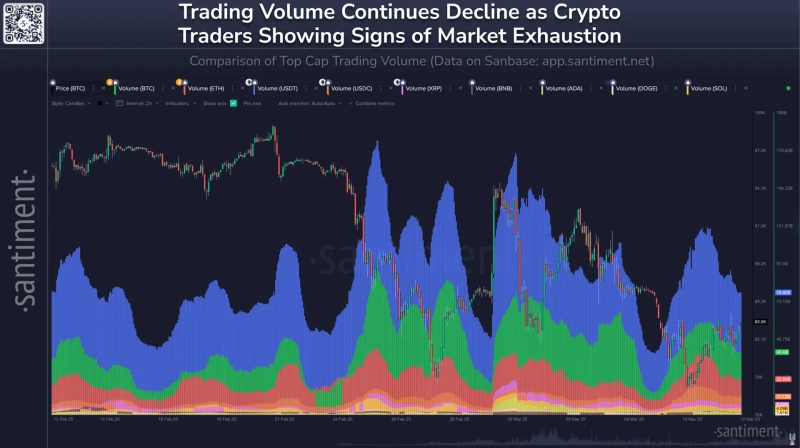

Market experts analyzed that overall cryptocurrency trading volume has decreased while investor sentiment has become unstable. With declining trading volume and persistent high volatility, opinions in the market are divided on whether altcoins are forming a bottom. There are also analyses suggesting that Trump's 'tariff war' and macroeconomic uncertainty are adding additional pressure factors.

Despite improving US inflation indicators, uncertainty over Trump's tariff policies is pressuring the market. Cryptocurrency service provider Matrixport analyzed in a report on the 14th, "US inflation indicators announced this week recorded slightly better figures than expected, but did not provide reassurance to the market" and that "as uncertainty over the Trump administration's tariff policies persists, the likelihood of the US making early interest rate cuts is decreasing." They also predicted that "even if future inflation indicators turn out better than expected, the strength of any rebound will be limited."

As investor sentiment deteriorates, trading volume across the cryptocurrency market continues to decline. Cryptocurrency data analytics firm Santiment analyzed in a research report on the 13th, "Overall cryptocurrency trading volume has been steadily decreasing since peaking on the 27th of last month" and that "investors are expressing fatigue, and as resignation and 'capitulation' psychology spreads, movements to liquidate positions are also appearing." Recently, investors have become less confident that additional purchases will lead to profits, which has led to decreased trading volume and increased uncertainty, according to the explanation.

As market momentum weakens, there are also observations that it is still too early to expect a solid rebound at present. Santiment warned, "Rebounds occurring in a state of decreased trading volume suggest that market momentum is weakening" and that "the current market may lack the strength to sustain an upward trend without strong buying inflows. There is also a high possibility of reverting to a downward trend." They added, "If individual and institutional investors continue to watch each other's moves, prices are likely to stagnate or face gradual downward pressure."

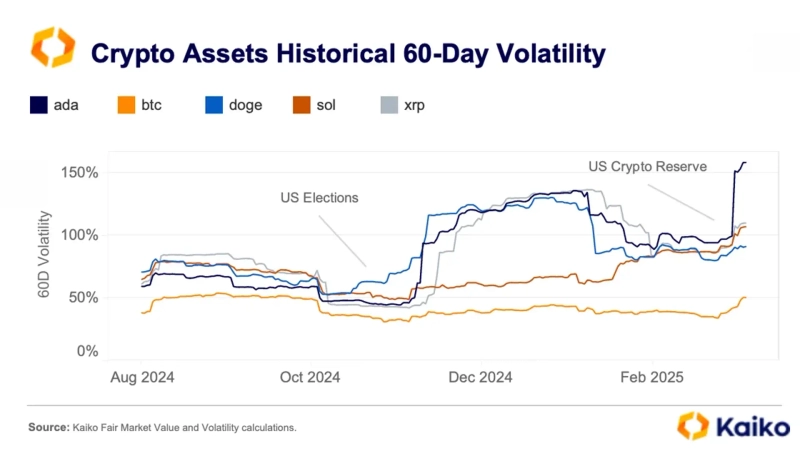

There is also an analysis that short-term investor sentiment has been dampened as the Trump administration's cryptocurrency strategic reserve plan fell short of expectations. Cryptocurrency data analytics firm Kaiko diagnosed in a recent research report, "As the Trump administration's cryptocurrency strategic reserve plan was less robust than expected, sharp volatility was triggered in the market." According to Kaiko, volatility in the altcoin market has surged this month. Cardano reached 150% volatility, breaking its all-time high, while Solana and XRP also showed high volatility exceeding 100%.

On the other hand, there are also positive assessments that Trump's policies could alleviate long-term selling pressure. Kaiko analyzed, "The Trump administration has announced plans to build a Bitcoin stockpile called 'Digital Fort Knox' and not to sell existing Bitcoin holdings" and that "this is likely to alleviate selling pressure (in the long term)." Previously, just before President Trump's reinauguration, the US Department of Justice (DOJ) approved the sale of 69,370 BTC, triggering selling pressure.

There are also analyses suggesting that the cryptocurrency market is showing movements similar to traditional financial markets. Famous cryptocurrency strategist Michael van de Poppe said through his YouTube channel, "I think the altcoin market is in the stage of forming a bottom. The gradually growing fundamentals will eventually be reflected in market prices." The strategist explained, "The cryptocurrency market no longer moves according to a '4-year cycle,' but is governed by liquidity cycles and macroeconomic flows" and that "as the cryptocurrency market matures, it is increasingly showing movements similar to traditional financial markets." He added, "I advise investors to remain in the market with patience."

Kang Min-seung, BloomingBit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)