Editor's PiCK

US Bitcoin Spot ETF sees $165.79 million inflow yesterday... 5 consecutive trading days

Summary

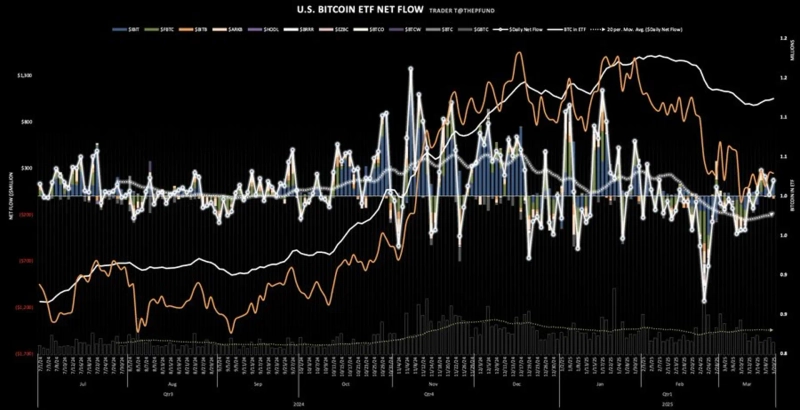

- The US Bitcoin Spot ETF reported a strong capital inflow for 5 consecutive trading days, totaling $695 million.

- In particular, BlackRock IBIT recorded a net inflow of $172.17 million, attracting the most funds.

- On the other hand, Bitwise BITB and Grayscale GBTC recorded net outflows of $17.4 million and $7.98 million, respectively.

The US Bitcoin (BTC) Spot ETF continues to show strong inflows, recording net inflows for 5 consecutive trading days.

On the 21st (local time), according to TraderT, the US Bitcoin Spot ETF recorded a total net inflow of $165.79 million (approximately 243.3 billion KRW) the previous day. The cumulative net inflow over the past 5 days amounts to $695 million (approximately 1.02 trillion KRW).

On this day, BlackRock IBIT attracted the most funds with a net inflow of $172.17 million. It was followed by VanEck HODL with $11.9 million, Fidelity FBTC with $9.19 million, and Grayscale Mini BTC with $5.22 million.

On the other hand, Bitwise BITB recorded a net outflow of $17.4 million, and Grayscale GBTC saw a net outflow of $7.98 million. The other products had no net inflow or outflow.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)