[Analysis] "Long-term and large investors enter Bitcoin accumulation phase... Suggesting potential for further rise"

Summary

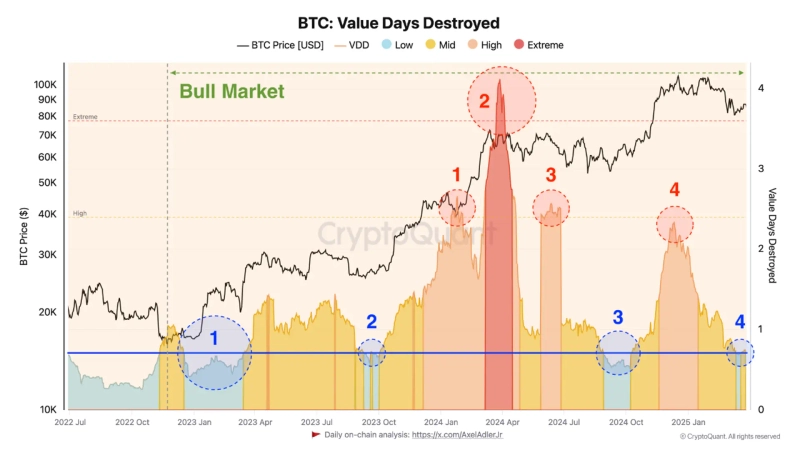

- AxelAdlerJr, a contributor to CryptoQuant, reported that the recent VDD indicator low indicates the start of Bitcoin accumulation.

- After the VDD indicator recorded a low, long-term holders avoided selling, suggesting a potential rise in Bitcoin prices.

- Historically, there have been instances where Bitcoin prices rose after the VDD indicator bottomed out.

An analysis has emerged that long-term and large investors have started accumulating Bitcoin (BTC).

On the 30th (local time), AxelAdlerJr (AAJ), a contributor to CryptoQuant, stated, "Recently, the Value Days Destroyed (VDD) indicator is recording a low," and analyzed that "this indicates that the time has come for long-term and large investors to accumulate Bitcoin." The VDD indicator is an on-chain metric that observes the movement of long-held Bitcoins. The higher the indicator, the more transactions of long-held Bitcoins, and conversely, the lower the indicator, the fewer transactions of long-held Bitcoins.

According to the chart shared by AAJ, VDD recorded its lowest point in January and October 2023, October 2024, and March 2025. AAJ explained, "The fact that long-term holders are not selling means that the current Bitcoin price is unsuitable for profit-taking," and "historically, Bitcoin prices have risen after the VDD bottomed out."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)