Summary

- Hyperliquid recorded a daily trading volume of $4 billion, securing over 60% of the market share among decentralized exchanges (DEX).

- Hyperliquid has formed a competitive structure with centralized exchanges (CEX) and has ranked 14th among major derivatives exchanges.

- Hyperliquid holds a larger open interest than the derivatives exchanges of Crypto.com, BitMEX, and KuCoin.

The decentralized exchange (DEX) Hyperliquid (HYPE) has significantly increased its market share.

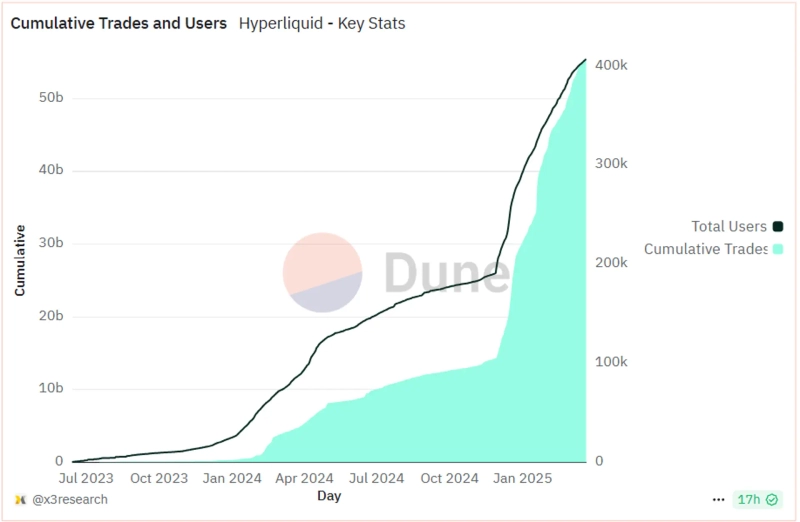

According to the cryptocurrency specialist media outlet Cointelegraph on the 31st (local time), Hyperliquid recently recorded a daily trading volume of $4 billion, securing over 60% of the market share among decentralized exchanges. Additionally, Hyperliquid's cumulative number of transactions recently surpassed 50 billion.

Cointelegraph evaluated Hyperliquid's progress as the first case of a decentralized exchange creating a competitive structure with centralized exchanges (CEX). In fact, in the cryptocurrency exchange rankings based on open interest size by Coingecko, Hyperliquid recorded $2.9276 billion, ranking 14th among all derivatives exchanges. This is larger than the derivatives exchanges of Crypto.com, BitMEX, and KuCoin.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)