Summary

- Meme coins have recently shown a significant decline due to the impact of Trump's tariff policy.

- The prices of top meme coins like Dogecoin and Shiba Inu have fallen, leading to a contraction in investor sentiment.

- Analysts suggest that macroeconomic uncertainty caused by the tariff policy has weakened investment sentiment towards risk assets.

Meme coins, considered the riskiest assets in the virtual asset (cryptocurrency) market, are showing a bearish trend during the day.

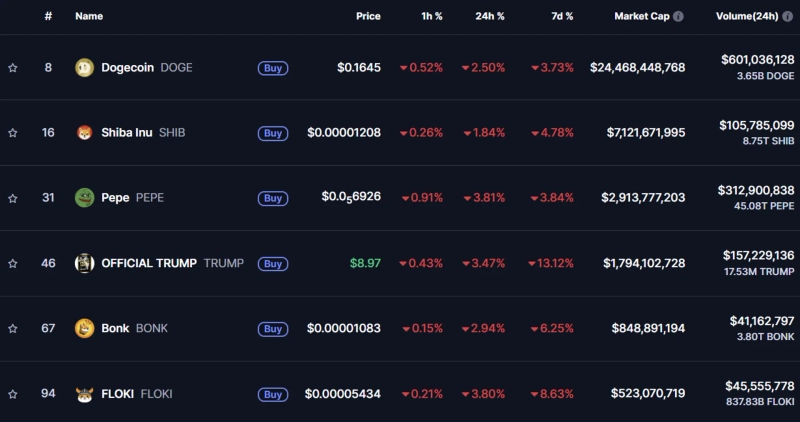

As of 5:36 PM on the 6th (Korean time), the leading meme coin, Dogecoin, is down 2.50% from the previous day, trading at $0.1645.

It's not just Dogecoin. At the same time, other top meme coins by market capitalization, such as Shiba Inu (-1.77%), Pepe (-3.64%), Official Trump (-3.44%), Bonk (-2.73%), Floki (-3.68%), and Fartcoin (-6.48%), have all declined compared to the previous day.

The factor attributed to the decline of these meme coins is the aggressive tariff policy of U.S. President Donald Trump. On the 2nd (local time), President Trump announced large-scale reciprocal tariffs, including a basic 10% tariff, targeting major trading partners. The aggressive tariff policy has increased macroeconomic uncertainty, leading to concerns about inflation expansion and a global economic downturn, which in turn has significantly dampened investment sentiment in risk assets.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)