Summary

- Bitcoin showed a mild decline compared to stocks amid tariff turmoil.

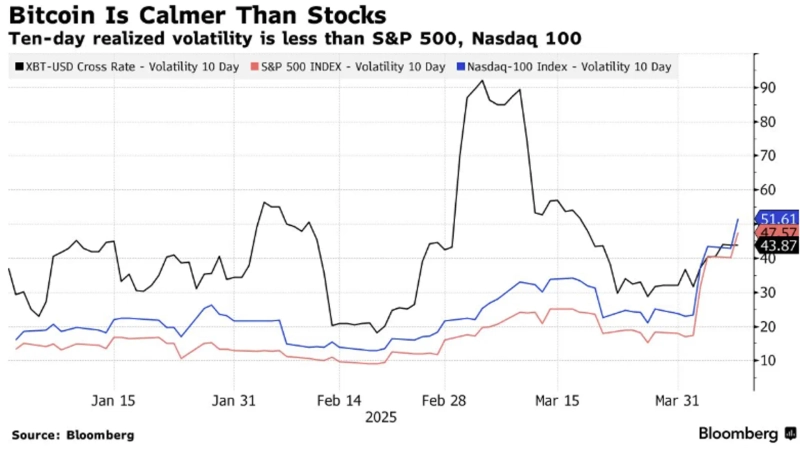

- Bitcoin's realized volatility was reported to be lower than stock indices.

- Bitcoin's decline over the past month and leverage reduction enabled it to defend its price in this tariff shock.

In the asset market, the volatility of Bitcoin (BTC) is drawing attention as President Donald Trump's tariff shock continues. This is because Bitcoin recorded a relatively mild decline amid macroeconomic turmoil compared to stocks.

On the 8th (local time), Bloomberg News reported, "Since the announcement of Donald Trump's tariff policy, the stock market has shown more extreme volatility compared to Bitcoin, which is a historically significant change," and "Unlike stocks, digital assets seem to be less affected by tariffs."

Vele Rude, head of K33 Research, said, "We should note the fact that Bitcoin has not crashed," and "Bitcoin has shown strength compared to stock indices since President Trump's tariff policy was announced on the 2nd. It's a very unusual event."

In fact, over the past 10 trading days, Bitcoin's realized volatility recorded 43.86, showing a lower level of volatility compared to the S&P 500 Index (47.29) and the Nasdaq Index (51.26).

The significant reduction in Bitcoin's market size due to the decline over the past month was also cited as a factor that allowed Bitcoin to defend its price in this tariff situation. Ravi Doshi, head of FalconX, explained, "Bitcoin had already experienced a decline over the past month, which significantly reduced Bitcoin leverage," and "This is why it achieved better performance than stocks in this tariff shock."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)