Summary

- A CoinShares analyst reported that the surge in global M2 increases the likelihood of a Bitcoin rebound.

- Bitcoin has historically tended to hit all-time highs with increases in money supply.

- Trump's fiscal easing policies, along with benefits like low interest rates and currency issuance, could lay the foundation for a Bitcoin bull market.

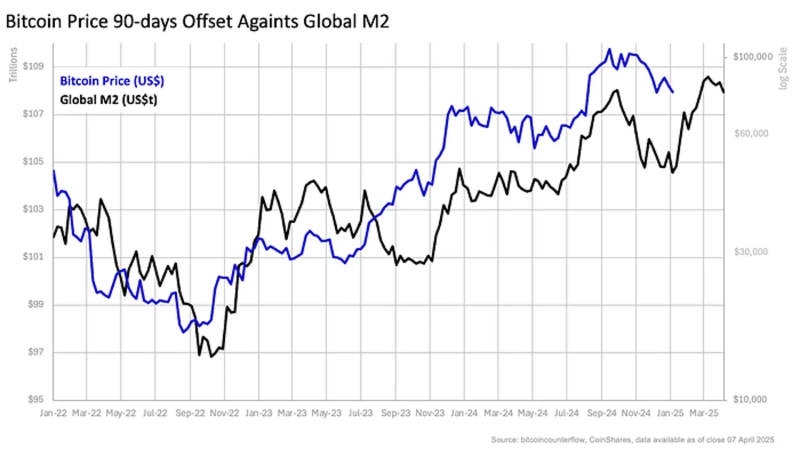

As global M2 (financial products issued by deposit-taking institutions, cash currency, transaction deposits, deposits under two years) has surged rapidly, an analysis suggests that Bitcoin (BTC) could rebound by following this trend.

On the 9th (local time), Christopher Bendiksen, an analyst at CoinShares, stated in a report, "Historically, Bitcoin tends to hit all-time highs when global money supply surges," adding, "Since the second half of last year, global M2 has been rising sharply. We can expect a rebound in Bitcoin."

He further explained, "If U.S. President Donald Trump's intended fiscal easing policies are implemented, a solid foundation for a bull market will be established," and "If major macroeconomic benefits such as low interest rates and currency issuance continue to appear, the Bitcoin bull market may not have even started yet."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)