Summary

- It was reported that a total of $252.16 million in positions were liquidated in the virtual asset perpetual futures market.

- Bitcoin and Ethereum showed the greatest volatility, recording liquidation amounts of $70.97 million and $49.13 million, respectively.

- The virtual asset market rebounded due to the U.S. government's exclusion of reciprocal tariffs.

The position liquidation size in the perpetual futures market for virtual assets (cryptocurrency) has reached $252.16 million.

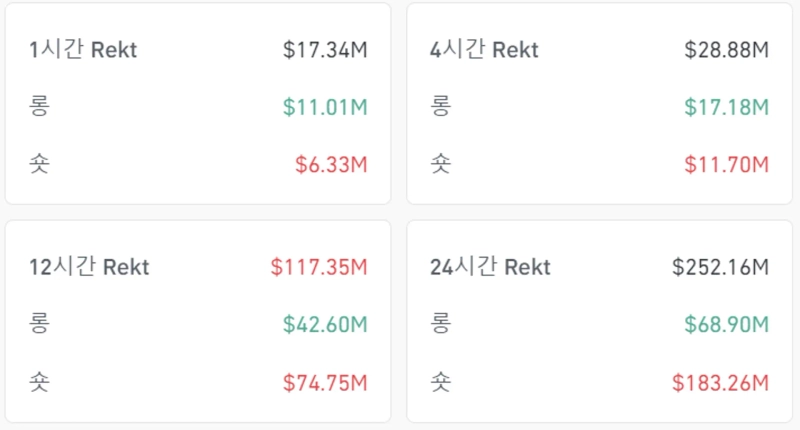

According to CoinGlass data on the 13th (local time), a total of $252.16 million worth of futures positions were liquidated in the virtual asset market over the past 24 hours. Most of these were short (sell) position liquidations. The virtual asset market rebounded after the U.S. government excluded smartphones, semiconductors, PCs, etc., from the 'reciprocal tariff' application on the 11th (local time). Specifically, $183.26 million of short positions were liquidated, and $68.90 million of long (buy) positions were liquidated.

The asset with the largest liquidation size was Bitcoin (BTC). Bitcoin saw $70.97 million in position liquidations over 24 hours, with $58.58 million in short positions and $12.40 million in long positions liquidated. The leading altcoin, Ethereum (ETH), ranked second, with $49.13 million disappearing in the same period. The liquidation sizes for short and long positions were $34.13 million and $15.00 million, respectively.

As of 11:36 AM, based on Binance USDT market, Bitcoin and Ethereum are trading at $84,885 and $1,614, respectively, up 2.04% and 3.90% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)