Editor's PiCK

"Optimistic About Withdrawal of Smartphone and Semiconductor Tariffs"... Increase in Virtual Asset Open Interest

Summary

- The United States has withdrawn reciprocal tariffs on smartphones and semiconductors, reducing market uncertainty.

- In the virtual asset market, the increase in open interest is seen as an expectation for a market rebound.

- Particularly, the sharp increase in open interest for Bitcoin and Solana suggests increased investor sentiment.

With the United States excluding smartphones, computers, and semiconductors from 'reciprocal tariffs', there is an opinion that a rebound in the virtual asset (cryptocurrency) market is expected. Additionally, the increase in major virtual asset open interest (OI) also suggested investors' expectations for a rebound.

On the 13th (local time), Ash Crypto, a virtual asset analyst, stated on X, "The United States has withdrawn reciprocal tariffs on smartphones, semiconductors, and computers (including China)," adding, "The trade war between the United States and China is coming to an end. It is a very optimistic factor for a market rebound."

He particularly emphasized the large import of electronic devices from China. He said, "Last year, the goods China exported to the United States were worth about $440 billion," adding, "Among them, smartphones, computers, and semiconductors account for $100 billion." He explained that with the announcement of the tariff targets, the tariffs on $100 billion worth of goods will disappear, significantly reducing market uncertainty.

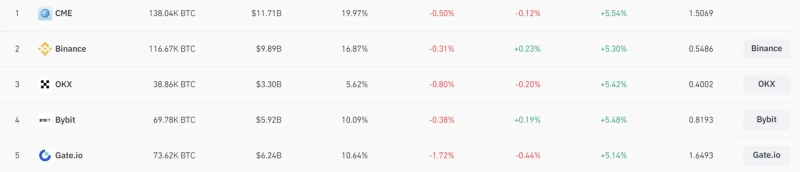

In fact, after the announcement, virtual asset open interest increased significantly.

According to CoinGlass data, Bitcoin (BTC) open interest increased by a total of 4.73% over the past 24 hours, and the open interest of Ethereum (ETH) and Ripple (XRP) also recorded increases of 3% and 9%, respectively. In the case of Solana (SOL), open interest increased by a whopping 17.67%, reflecting increased investor sentiment in the virtual asset market.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)