Summary

- Matrixport reported that stablecoin inflows remain strong despite the tariff war.

- Virtual assets are evolving into independent assets with less correlation to risky assets.

- Stablecoin inflows indicate increased interest and liquidity, and the market outlook is positive.

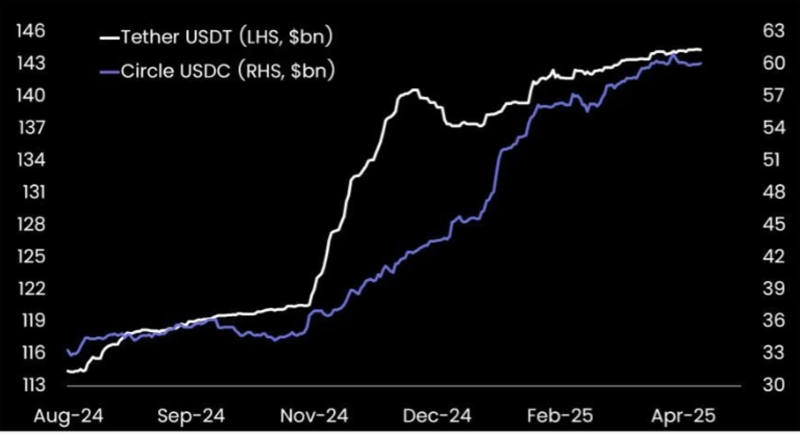

Amidst the global tariff war, where investment sentiment in risky assets has decreased, an analysis has emerged that stablecoin inflows remain strong.

On the 15th (local time), Matrixport stated in a report, "The pace of stablecoin inflows is still showing a gradual upward trend," and "virtual assets are gradually evolving into independent assets with less correlation to other asset classes." Despite the macro environment causing instability in the stock and bond markets, the virtual asset market is showing a positive trend with increasing stablecoin inflows.

Matrixport mentioned, "The inflow of stablecoins indicates increased interest and liquidity in the market," and "the use cases for virtual assets are gradually increasing due to international disputes. The future market outlook is positive."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)