Summary

- The Bank of Korea announced its decision to freeze the base rate until the uncertainty of US tariff policies clears.

- Governor Changyong Lee mentioned the possibility of a downward revision of Korea's Q1 growth rate and indicated an intention to lower rates next month.

- Experts predict that the Bank of Korea will lower the overall economic growth rate from the existing 1.5% to the 1.1~1.3% range.

All 6 Monetary Policy Committee Members "Should Leave Room for a Rate Cut Within 3 Months"

Rate Freeze Amid Uncertainty

Suddenly Dark Tunnel Due to US Tariffs

Wait Until It Brightens While Adjusting Speed

Another Growth Rate Downgrade in Two Months

Couldn't Predict Large Wildfires and Political Instability

Annual Growth Forecast Likely to Drop to Early 1% Range

Supplementary Budget of 12 Trillion Won Could Raise Growth Rate by 0.1%P

Excessive Economic Stimulus Has Huge Side Effects

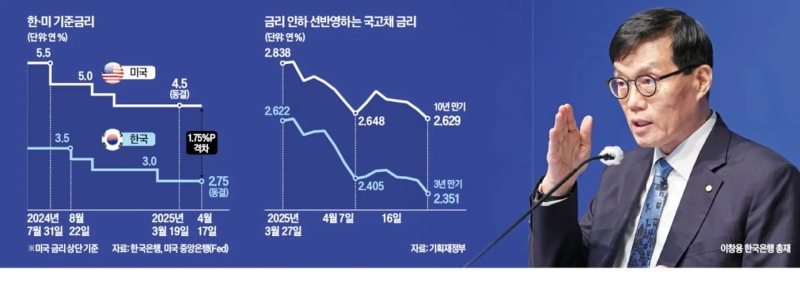

The Bank of Korea's decision to freeze the base rate at 2.75% per annum on the 17th, despite economic contraction and worsening trade conditions, is interpreted as waiting for the uncertainty of US tariff policies to clear. Governor Changyong Lee of the Bank of Korea likened the current situation to "suddenly entering a dark tunnel," saying, "In such a situation, it might be better to wait until it brightens while adjusting speed." The Bank of Korea clearly indicated its intention to lower rates next month. The market paid more attention to the Bank of Korea's economic situation assessment that the economy is cooling faster than initially expected, rather than the rate decision that met expectations.

"Significant Downward Revision of Q1 Growth Rate"

The Bank of Korea, through its report on 'Evaluation of Q1 and Future Growth Trends' released immediately after the Monetary Policy Committee's monetary policy direction meeting, assessed that "the Q1 growth rate (compared to the previous quarter) cannot rule out the possibility of a slight negative." It is unusual for the Bank of Korea to pre-announce the quarterly growth rate situation ahead of the revised economic outlook announcement on the 29th of next month.

In its economic outlook announced in February, the Bank of Korea lowered the Q1 growth rate to 0.2% from 0.5% (November forecast last year), considering domestic demand stagnation due to the prolonged impeachment situation. It means that the growth rate will be adjusted significantly again in less than two months.

Hageonhyeong, a researcher at Shinhan Investment Corp., analyzed, "Looking at the domestic and export data for January and February, the growth rate could be around 0.4%," adding, "The March economic data, which has not yet been disclosed externally, has deteriorated sharply." Governor Lee also said, "We didn't know that large wildfires would occur in Q1, and we didn't know that political uncertainty would last long," adding, "Even without considering the US tariff shock, there is a high possibility that the Q1 growth rate will be significantly revised downward." Experts predict that the Bank of Korea will lower the overall economic growth rate for this year from the existing 1.5% to the 1.1~1.3% range.

"Judgment Based Solely on Economy, Not Politics"

Considering this economic situation, the Bank of Korea clearly signaled to the market that it would lower rates at the Monetary Policy Committee next month. Governor Lee, in response to a question about 'forward guidance' that informs the direction of monetary policy for three months, said, "All six Monetary Policy Committee members (excluding the governor) believe that the possibility of lowering the base rate below 2.75% per annum within three months should be left open." Yoon Yeosam, a researcher at Meritz Securities, explained, "It's a clear message that the rate will be lowered at the Monetary Policy Committee on the 29th of next month," but added, "This outlook has already been reflected in the market, so the bond and foreign exchange markets were not affected."

Governor Lee's remarks that monetary policy decisions would be made regardless of the presidential election schedule also supported the May rate cut theory. He emphasized, "The market will naturally interpret it as a high possibility of a May cut," in response to concerns that lowering rates five days before the presidential election could cause unnecessary misunderstandings, adding, "We will judge solely based on the economic situation, not considering politics."

"Monetary and Fiscal Policy Should Cooperate"

There is also an analysis that the Bank of Korea's decision on a 'dovish rate freeze' was to save room for monetary policy. At the current base rate, the rate can be lowered three times by 0.25 percentage points each to the potential growth rate level of 2.0%. Governor Lee was cautious when asked about the possibility of lowering the base rate more than the market's expectation of two cuts within the year, saying, "We need to judge how much the (downward) range will be when we make the (revised) economic outlook in May."

There is also an interpretation that the timing of the rate cut is delayed to maximize the effect of monetary policy. Governor Lee said, "When the economy deteriorates like this, it's difficult to manage with just monetary or fiscal policy," adding, "Both sides need to cooperate to some extent." Regarding the size of the supplementary budget, he also warned, "If the supplementary budget is executed at 12 trillion won as proposed by the government, it will have the effect of raising the economic growth rate by about 0.1 percentage points," adding, "In a situation where the global growth rate is declining, if only our economy is stimulated above the potential growth rate, we will experience enormous side effects."

Reporter Leftdonguk leftking@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.