Summary

- An analysis has emerged indicating that Bitcoin mid-term holders are showing stronger re-accumulation movements.

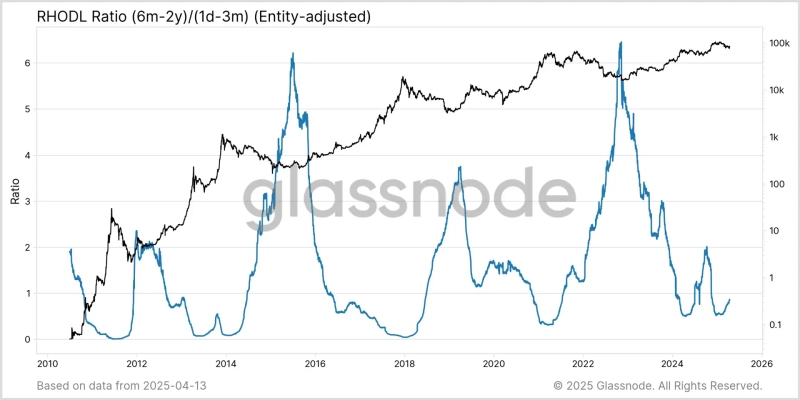

- Glassnode reported that the Bitcoin RHODL ratio has doubled compared to February, signaling mid-term holders' accumulation.

- The RHODL ratio, which shows the weakening speculative sentiment of short-term holders, is an important indicator for determining market overheating.

An analysis has emerged indicating that Bitcoin (BTC) mid-term holders are showing increased re-accumulation movements.

On the 18th (local time), Glassnode stated on X (formerly Twitter), "The Bitcoin RHODL ratio has risen above 0.2, doubling from 0.1 in February," adding, "This is a signal that the speculative sentiment of short-term holders is weakening, and the accumulation movement of mid-term holders is strengthening." The RHODL ratio is an indicator that considers the realized value between short-term and mid-term holders to determine market overheating.

As of 9:28 PM, Bitcoin is trading at $84,646 on the Binance USDT market, down 0.20% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)