Summary

- It was reported that the monthly average trading volume of virtual asset exchanges hit the lowest in 6 months.

- Analyzing the trading volume of major exchanges, it was revealed that it sharply declined by about 75% compared to early December, which seems to be due to macroeconomic uncertainty.

- As spot trading volume decreased significantly, the 'spot to futures ratio' decreased to 0.19, indicating that investment demand using leverage has increased.

Amid increasing macroeconomic uncertainty due to Donald Trump's tariff policies, it has been observed that the trading volume of virtual asset (cryptocurrency) investors has plummeted.

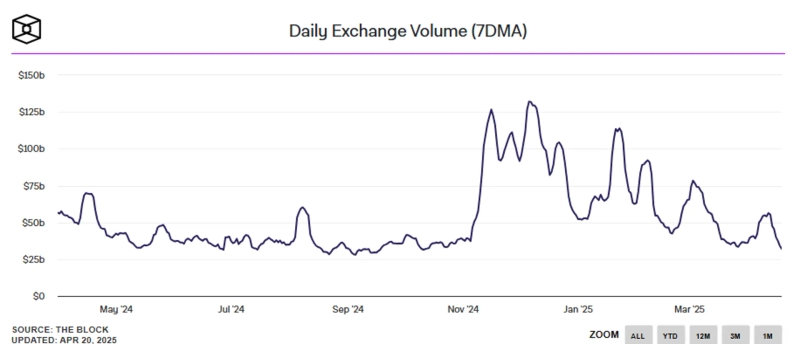

On the 20th (local time), The Block, a media outlet specializing in virtual assets, reported that the trading volume of virtual asset investors hit a six-month low, citing data from Binance, Coinbase, and Bitfinex.

According to the data, the 7-day moving average trading volume of exchanges such as Binance, Coinbase, and Bitfinex was only $32 billion on the 19th. This is the lowest level since mid-October 2024 and represents a sharp decline of about 75% compared to early December (132 billion dollars).

During this period, as spot trading volume plummeted, the 'spot to futures ratio' recorded 0.19. This means that spot trading volume accounted for 19% of futures trading volume during the same period. The Block evaluated this by stating, "It can be seen that speculative investment demand using leverage is greater than the demand to use actual tokens among current investors."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.