Trump Seeking Exit Strategy "Tariffs on China Will Be Significantly Lower"

Summary

- President Trump has indicated that he may significantly lower the high tariffs on China, raising investors' expectations.

- U.S. stocks rose sharply on the possibility of President Trump easing tariff policies.

- U.S. Treasury Secretary Besant conveyed that while negotiations with China may not be easy, there is a possibility of easing U.S.-China tensions.

Besant High Tariffs "Not Sustainable"

U.S. President Donald Trump has indicated that he may lower the tariff rates on China. The burden of maintaining high tariffs on China, which reach at least 145%, has increased. He also retracted his statement about firing Jerome Powell, the Chairman of the U.S. Federal Reserve (Fed). The market, which had plummeted the previous day due to U.S.-China tensions and pressure to dismiss Chairman Powell, welcomed President Trump's 'retreat.'

On the 22nd (local time), President Trump, after the swearing-in ceremony of Paul Atkins as Chairman of the Securities and Exchange Commission (SEC) at the White House, responded to a question about trade negotiations with China, saying, "145% (reciprocal tariffs on China + fentanyl tariffs) is very high," and "(after negotiations, the tariff rate) will not be that high, and it will go down significantly."

However, he added, "It will not be zero (0%)." He further stated that in the past, the tariff rate on China was "zero (level), and we were completely destroyed then." He argued that the massive import of cheap Chinese goods led to the collapse of American manufacturing.

President Trump also said that the U.S. is "currently in a golden age" and that "China wants to be part of it." When asked if he would take a strong stance in trade negotiations with China, he replied, "No. We will treat them very well, and they will do the same." President Trump stated, "In the end, they have to negotiate," and "If they do not negotiate, we will decide on it and set the numbers (tariff rates)." He added that this process would "proceed very quickly."

U.S. Treasury Secretary Scott Besant also hinted at the possibility of easing U.S.-China tensions. According to Bloomberg News, he attended a private event for investors hosted by JP Morgan that morning and said that the stalemate with China is "not sustainable." He also said, "I expect the situation to ease." However, unlike President Trump, who conveyed an optimistic view, Secretary Besant added that negotiations with China would be "difficult and take a long time." He stated that the Trump administration's goal is not the decoupling of the U.S. and Chinese economies, but rather a "big and beautiful readjustment" where China increases consumption and the U.S. strengthens manufacturing. However, he assessed that it is "uncertain" whether China is ready for that.

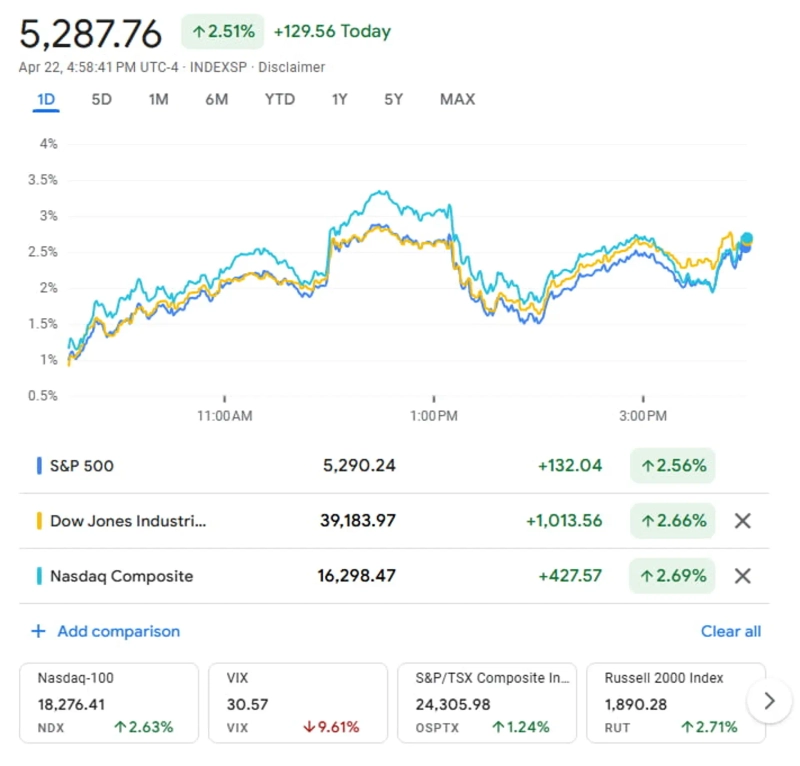

The market welcomed President Trump's change of stance. U.S. stocks rose sharply, shaking off the previous day's slump. The S&P 500 index rose by 2.51%, the Dow Jones Industrial Average by 2.66%, and the Nasdaq index by 2.71%. The dollar index, which had hit its lowest level in three years the previous day, recovered to 99.2. The price of gold, which had hit $3,500 per troy ounce the previous day, also fell to the low $3,350 range.

Washington Correspondent Lee Sang-eun selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.