Tariff War with China Eases in Two Weeks... Trump: "145% is Too High" [Lee Sang-eun's Washington Now]

Summary

- US President Donald Trump imposed ultra-high tariffs on China but mentioned the possibility of lowering the tariff rates.

- The International Monetary Fund (IMF) predicted that the US will experience inflation and a slowdown in growth due to rising prices of Chinese imports, while China will face deflation and a slowdown in growth due to reduced exports.

- It was stated that if ultra-high tariffs at the level of trade severance continue, both countries will suffer significant economic shocks.

IMF, if the tariff war continues

US faces 'supply shock' leading to inflation + slowdown

China faces 'demand shock' leading to deflation + recession

"Based on China's lack of respect for the global market, we will immediately raise the reciprocal tariffs on China to 125%." (April 9)

"145% is too high a level. It will not remain this high." (April 22)

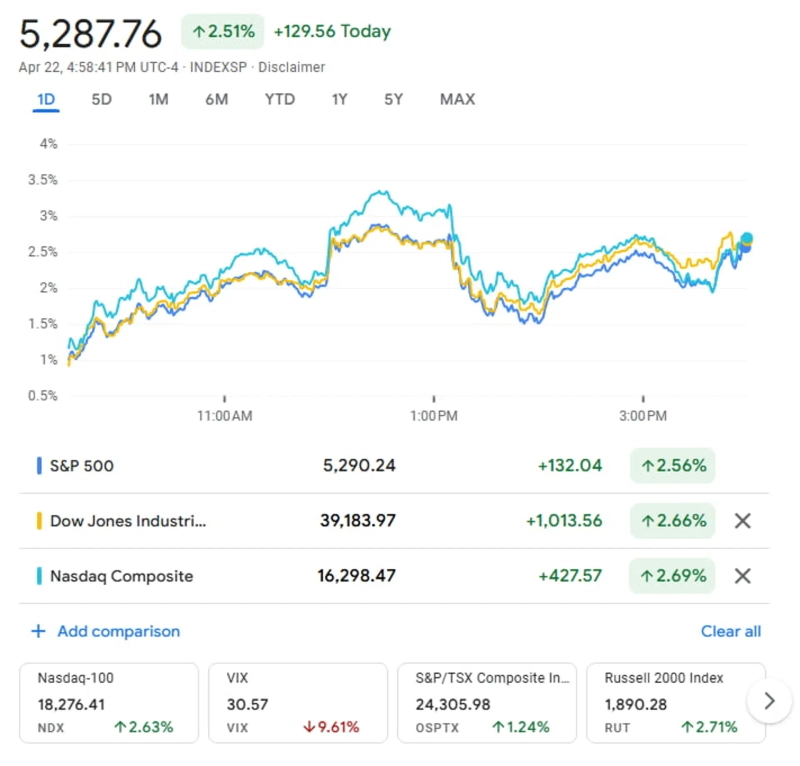

US President Donald Trump, who has created an extreme US-China conflict by imposing ultra-high tariffs on China, directly mentioned the possibility of significantly lowering the tariffs on April 22 (local time), expressing a desire for an amicable resolution. There is an evaluation that the phase of the tariff war is rapidly shifting.

President Trump, after the inauguration oath of Paul Atkins as Chairman of the Securities and Exchange Commission (SEC) at the White House, received a question about trade negotiations with China and said, "145% (reciprocal tariffs on China + fentanyl tariffs) is very high," adding, "(After negotiations, the tariff rate) will not be that high and will go down significantly."

However, he said, "It will not be zero (0%)." He added that in the past, the tariff rate on China was "zero (level), and at that time we were completely destroyed." He argued that the massive import of cheap Chinese goods led to the collapse of American manufacturing.

President Trump also said that the US is currently in a "golden age" and that "China wants to be part of it." When asked if he would take a strong stance in trade negotiations with China, he replied, "No. We will treat them very well, and they will do the same." President Trump said, "Eventually, they have to negotiate," adding, "If they do not negotiate, we will decide it and set the numbers (tariff rates)." He added that this process will "proceed very quickly."

Preference for Top-Down Approach Stalls Negotiations

Since winning the election last November, President Trump has consistently emphasized the need to impose tariffs on China while showing a willingness to negotiate. After announcing reciprocal tariffs on the entire world on the 2nd, he offered a 90-day grace period (on the 9th) to all countries except China, isolating China and repeatedly urging them to come to the negotiating table by raising the tariff rate to at least 145%.

In response, China imposed a retaliatory tariff of 125%, raising the effective US tariff rate on China to 115% and China's effective tariff rate on the US to 146% (IMF statistics). Treasury Secretary Scott Besant commented that the two countries have effectively "implemented trade bans."

The problem was the negotiation method. In the early days of the Trump administration, Chinese officials showed a willingness to negotiate by trying to understand what President Trump wanted. China also showed a receptive attitude by not responding significantly during the process when the Trump administration imposed a 20% tariff related to fentanyl twice in February.

However, what President Trump wanted was 'direct communication between leaders,' as he had done with Mexico, Canada, the UK, Japan, and Russia. He publicly mentioned several times that Chinese President Xi Jinping would call him. While this might be familiar to President Trump, it is not a preferred method for President Xi. As the tariff war intensified rapidly, President Xi's room for maneuver became more limited.

A diplomatic source in Washington evaluated, "For President Xi, who could not avoid the triggering of the US-China tariff war despite visiting the Mar-a-Lago resort during the first Trump administration, the burden of recreating a second Mar-a-Lago visit situation is significant."

Trump's 'Optimism', Besant's 'Caution'

While there may be ongoing behind-the-scenes negotiations between the two countries, it is difficult to confirm whether they have reached a level where the negotiation results can be announced soon, as President Trump optimistically predicted. Last week, President Trump also said, "An agreement will be reached within 3-4 weeks." He also used the expression, "Even if they do not agree, we will make an agreement." On this day, he also mentioned, "If China does not negotiate, we will decide the numbers."

Secretary Besant showed a more cautious attitude. He added at a private event with JP Morgan investors that negotiations with China would be "difficult and take a long time." Secretary Besant stated that the Trump administration's goal is not to decouple the US and Chinese economies, but rather to want a "big and beautiful readjustment" where China increases consumption and the US strengthens manufacturing, but it is "uncertain" whether China is ready for that.

Stagflation vs Recession

The US and China have recently reduced their dependence on each other, but they are still deeply intertwined. The proportion of US exports to China is 7.2% (145 billion dollars last year), and the proportion of Chinese exports to the US is 12.4% (438.9 billion dollars). China mainly exports electronic devices such as mobile phones and laptops, as well as toys to the US, while the US sells soybeans, airplanes, and semiconductors to China. If goods exported to the US via Mexico and other countries are included, the trade volume between the two countries is estimated to be even larger.

Neither country wants the situation of ultra-high tariffs at the level of trade severance to continue. In the World Economic Outlook released by the International Monetary Fund (IMF) on this day, it was predicted that if the current level of tariffs is maintained, the US will experience inflation due to supply shocks from rising prices of Chinese imports, and the growth rate will fall. On the other hand, China is expected to experience deflation and a slowdown in growth due to demand shocks from reduced exports and increased uncertainty. It is also expected that China will try to mitigate the shock by implementing large-scale economic stimulus measures. Although the directions are different, the shocks that both economies have to endure are by no means small.

In the short term, President Xi, who can suppress public and corporate dissatisfaction and endure pain, may have an advantage. Adam Posen, president of the Peterson Institute for International Economics (PIIE), wrote in a Foreign Affairs article earlier this month, "What China, a surplus country, has to give up is money, and what the US, a deficit country, has to give up is goods and services," evaluating that the expansion advantage of the US-China conflict lies with China because goods or services are harder to replace than money.

The fact that President Trump has to consider the midterm elections next November also adds strength to the prediction that China will hold out. However, there is also considerable analysis that China, which does not have a domestic market as developed as the US, will find it difficult to endure if it cannot find export outlets.

Washington Correspondent Lee Sang-eun selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.