Sent a 'Let's do well' message to China... Why the Trump administration 'changed' [Lee Sang-eun's Washington Now]

Summary

- The U.S. Treasury Secretary stated that high tariffs with China are unsustainable and emphasized the need to resume U.S.-China trade negotiations through tariff adjustments.

- The U.S. White House spokesperson and Treasury Secretary pointed out the importance of bilateral negotiations, stating there will be no unilateral tariff reduction.

- As President Trump continues to make market-conscious remarks, U.S. stocks showed an upward trend.

"High Tariffs Unsustainable"

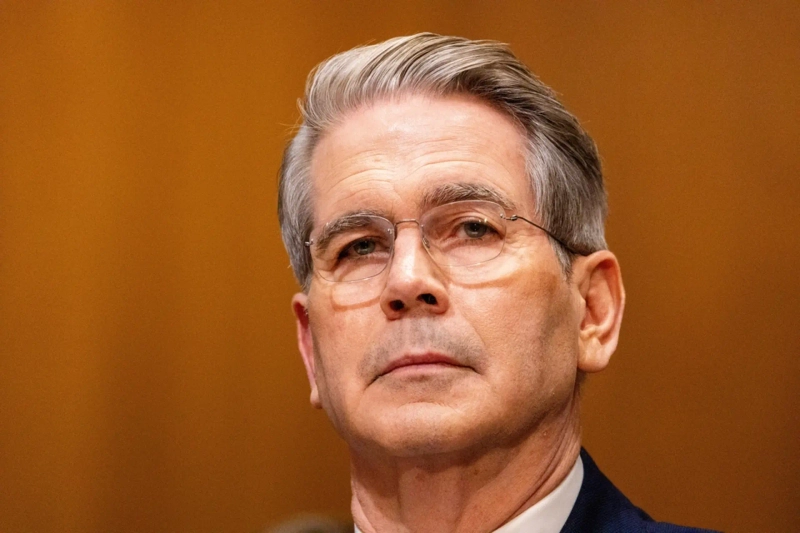

Scott Besant, the U.S. Treasury Secretary, stated over two days that the high tariffs on China are not sustainable. There is an assessment that the phase of U.S.-China conflict, which began in earnest when U.S. President Donald Trump announced reciprocal tariffs on the 2nd, has clearly shifted.

Secretary Besant, speaking at the Institute of International Finance (IIF) in Washington, D.C., on the 23rd (local time), said that it is necessary to lower the excessively high tariffs between the two countries before trade negotiations because "neither side believes this is a sustainable level." He repeated the same remarks to reporters' questions, saying that the current high tariffs are at a level of trade disruption and that "the stalemate with China cannot continue. The situation will ease."

The Wall Street Journal reported, citing White House officials, that there is a high possibility that the U.S. tariff rate on China will drop to between 50-65%. It is said that the U.S. is drafting a plan based on the U.S. House's proposal to impose at least 100% tariffs on items related to U.S. strategic interests and propose 35% tariffs on items unrelated to national security. Although it may not proceed exactly like this, the idea of significantly differentiating tariff rates between security-related and non-security-related items is presumed to be under discussion.

However, today, White House spokesperson Caroline Levitt said in a Fox News interview that "there will be no unilateral tariff reduction on China." Secretary Besant also said that they would not unilaterally lower tariffs. The U.S. will not first drop 145% unilaterally; tariffs will be lowered only if both countries negotiate. In the end, it is a conciliatory measure to urge China to negotiate. Nevertheless, it is interpreted that even within the Trump administration, the opinion that it is not enough to pressure China with a hard-line stance has become dominant.

In fact, it is not easy to verify from the outside exactly what level the U.S.-China negotiations are progressing. President Trump is speaking very optimistically. Last week, he said, "There is a possibility of reaching an agreement within 3-4 weeks." In recent days, he has said, "Even if they don't agree, we will make an agreement." Today, when reporters asked if they were making a deal with China, he replied, "It will be fair." It seems to be progressing well.

On the other hand, Treasury Secretary Besant is speaking in a more cautious tone. On the 22nd, he said that negotiations with China would be "difficult and take a long time." On the 23rd, he mentioned that it would take 2-3 years for trade with China to find balance again.

The market is ready to receive positively any message that the U.S.-China conflict is easing, but it is expected that there will be considerable push and pull and confusion in the process until both sides achieve visible results.

Both countries internally agree that it is difficult to bear the current level of trade disruption tariffs. Although the economic dependence between the two sides is somewhat lower than in the past, the trade volume is still very large. The proportion of China's exports to the U.S. is about 12.4%, and the proportion of U.S. exports to China is about 7.2%.

Because the economies are so deeply intertwined, there is a very high possibility of a recession if both sides continue to confront each other. The IMF, in its World Economic Outlook (WEO) released on the 22nd, predicted that if tariffs remain in this state, inflation will come to the U.S., and deflation will come to China. Since either side would be painful, both President Trump and President Xi need to watch out for losing public sentiment.

Especially since President Trump is facing midterm elections in November next year, there is a lot of evaluation that it is difficult to drag out the confrontation phase for too long. President Xi also does not want to show a loss of face to the public, so how the U.S. considers this will be key to the progress of negotiations.

Meanwhile, the market is cheering for President Trump's statement the day before that he has no intention of firing Chairman Powell and the easing of U.S.-China tensions. The U.S. stock market continued to rise today, with the S&P 500 index rising by 1.67% and most major stocks rising.

What the market confirmed this time is that President Trump is paying attention to the market. Although he has repeatedly sent the message to "hold on" in situations where the stock market plummets, bond yields rise, and the dollar value drops significantly, he is giving the impression that he is secretly paying attention and changing his message accordingly.

It is not certain whether he will not actually pursue the dismissal of Chairman Powell. Washington insiders analyze that if the situation becomes more favorable to him, he may still consider pursuing dismissal again or installing a shadow chairman to lead to a lame-duck situation. The Wall Street Journal reported that the White House legal team internally reviewed whether Chairman Powell could be dismissed for 'just cause.' Although the spark has subsided for now, it is interpreted as a situation that can be revived at any time.

Washington Correspondent Lee Sang-eun selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.