"The Ghost that Wrecked Japan's Economy"… Aiming for Korea After 40 Years [Kim Ik-hwan's Ministry Hands Up]

Summary

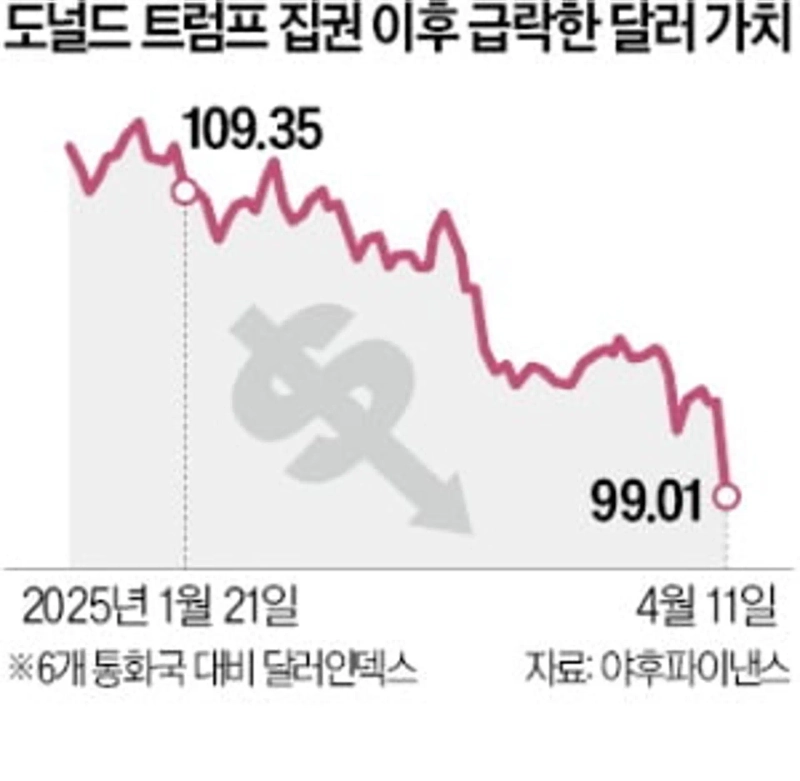

- The US's exchange rate pressure highlights the nightmare of the Plaza Accord for Korea.

- The US has hinted at the possibility of negotiating exchange rates with Korea, taking issue with the weak won.

- There is growing concern that the Korean economy may be entering a path similar to Japan's Lost 20 Years.

Exchange Rate Pressure Intensifies… Concerns of Korea's 'Plaza Accord' Nightmare

Will the US, like Japan in 1985, Take Issue with the Weak Won?

Japan at the Start of the 'Lost 20 Years'… Resembling the Korean Economy

"The second Pearl Harbor attack has begun."

In the 1980s, 'anti-Japanese sentiment' emerged in the United States. In 1941, Japanese fighter Zero-sen devastated Pearl Harbor. In the 1980s, as Japanese companies like Hitachi, Mitsubishi, Toshiba, Sony, and Toyota wrecked American manufacturers, the US media described it as the start of a 'second Pearl Harbor attack.' Around this time, workers in US cities began performances of smashing Japanese products.

September 22, 1985. Riding on 'anti-Japanese sentiment,' the US called finance ministers and central bank governors from Japan, Germany, the UK, and France to the Plaza Hotel in New York. Here, the US extracted an agreement to appreciate the yen against the dollar. Known as the 'Plaza Accord,' this agreement led to the loss of export competitiveness for Japanese companies and triggered a 'bubble economy.' It also became a trigger for Japan's 'Lost 20 Years.' The Trump administration is once again raising issues with the exchange rates of various countries. It has hinted at negotiating exchange rates with Korea. Concerns have grown that the nightmare of the 'Plaza Accord' that ruined Japan might be creeping up on Korea.

Choi Sang-mok, Deputy Prime Minister and Minister of Strategy and Finance, stated in a briefing on the results of the '2+2 Trade Talks' held in Washington DC on the 24th (local time) that "US Treasury Secretary Scott Besant proposed discussing the exchange rate." This proposal from the US Treasury was interpreted as an intention to make the exchange rate issue a major agenda item in the trade talks.

There are many evaluations that the weak won could be blamed for the US trade deficit, and there are concerns that the pressure level could be increased using the US Treasury's exchange rate report due next month as leverage. The US designated Korea as a monitoring country in its exchange rate report last November. Being a monitoring country is a kind of warning before being designated as a currency manipulator subject to US sanctions. As the won's value against the dollar has fallen further since last November, it is expected that Korea will remain a monitoring country.

However, the government evaluates that the recent weakness of the won is due to political uncertainty, among other factors. In addition, the foreign exchange authorities net sold $3.755 billion in the foreign exchange market in the fourth quarter of last year to slow the decline in the won's value. It is expected that the government will use these points to persuade the US during the negotiation process.

However, the atmosphere in the US is not good, as seen in the 'Miran Report' released by Steve Miran, Chairman of the White House Council of Economic Advisers, last November. The report, which argues for pursuing a depreciation of the dollar to strengthen US manufacturing competitiveness, is said to have formed the basis of the Trump administration's tariff policy. Major trading partners, including Korea, which have achieved significant trade surpluses with the US, are also trembling. There are growing concerns that they will be dragged into negotiations to appreciate their currencies against the dollar. They are worried about becoming the scapegoat of a second 'Plaza Accord.'

The concern is particularly great for Korea, which is following a path similar to Japan's economic flow. The Plaza Accord undermined Japan's manufacturing competitiveness, and the 'bubble economy' collapsed. The economic situation of Japan in 1985 is quite similar to our current situation. The global economic situation is also similar.

In response to the 'stagflation' (high inflation amid economic stagnation) that hit in the 1970s, the US raised the benchmark interest rate to 19.85% per annum in March 1980. As a result, the dollar value soared, and the cost of borrowing increased, worsening the competitiveness of US manufacturers. Export competitiveness weakened due to the strong dollar, and investment incentives weakened due to high interest rates. Japan, armed with strong manufacturing competitiveness and low interest rates, filled the gap left by the US and emerged as the world's strongest manufacturing power.

The US responded with the Plaza Accord in 1985. After the Plaza Accord, the yen appreciated by 65.7% against the dollar over two years. The Japanese government, fearing a loss of export competitiveness, released money into the market. The benchmark interest rate, which was 5% per annum in 1986, was lowered to 2.5% per annum within a year. The increased liquidity flowed into real estate and stocks. In 1987 alone, the average land price in Tokyo rose by 68.8%. However, manufacturing competitiveness gradually shifted to Korea, China, and Taiwan. Samsung Electronics secured competitiveness in the memory semiconductor field at this time. Eventually, Japan entered a long-term recession after losing export competitiveness and the collapse of the asset bubble.

In the first quarter of this year, Korea's economic growth rate recorded -0.2%, indicating that it is entering the early stages of a recession. The impact of the 'domestic demand shock' is significant. It is barely holding on with exports. There is high concern about the fact that Korea and the US have put exchange rates on the trade negotiation table. This is the background for the market and business community to watch the progress of these negotiations with high tension.

Reporter Kim Ik-hwan lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.