Editor's PiCK

After Tariffs, a Currency War?…Will the US Demand a 'Second Plaza Accord'?

Summary

- The inclusion of 'exchange rate policy' in Korea-US trade talks is heightening market tensions.

- The US has hinted at the possibility of pressuring trade partners to appreciate their currencies as the next step after tariffs.

- There is widespread speculation that the US is unlikely to actually demand the 'Mar-a-Lago Accord'.

Korea-US, Including Exchange Rates in Trade Talks

Strong Dollar Seen as Cause of Trade Deficit

Major Countries May Face 'Currency Appreciation Pressure'

No Yen Appreciation Demand on Japan

Some Say "Excessive Worry"

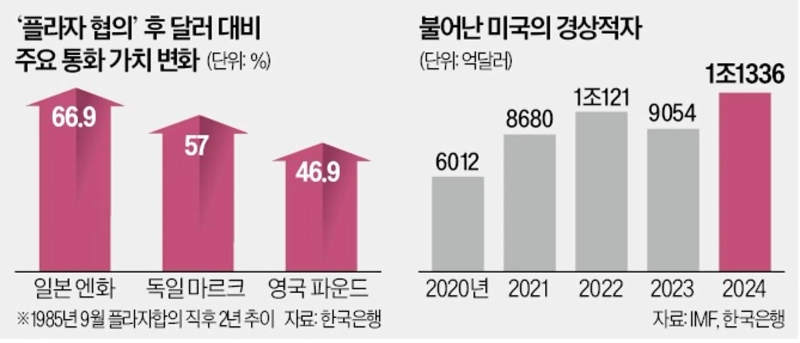

The inclusion of 'exchange rate policy' as a major agenda in Korea-US trade talks is raising tensions among authorities and markets. There are concerns that the US, suffering from chronic trade deficits, might escalate pressure on its trading partners to appreciate their currencies as the next step after tariffs. There are even pessimistic forecasts that the nightmare of the 1985 'Plaza Accord', which weakened Japan's export and manufacturing competitiveness by raising the yen's value against the dollar, might be replayed in Korea.

These concerns stem from the 'Miran Report' announced by Stephen Miran, a member of the White House Council of Economic Advisers, last November. The report, which argues for the need to pursue a depreciation of the dollar to strengthen US manufacturing competitiveness, is widely regarded as the foundation of the Trump administration's trade policy. It also suggests that to maintain dollar hegemony while inducing a 'weak dollar', the US should demand its allies purchase 50-year and 100-year US long-term treasury bonds.

Miran named this the 'Mar-a-Lago Accord', modeled after the Plaza Accord, hence the term 'Second Plaza Accord'.

However, there is widespread speculation that the US will not actually demand the Mar-a-Lago Accord. Unlike in 1985, this is not an era where one can artificially demand currency appreciation. The US did not demand yen appreciation from Japan, which began negotiations before Korea. US Treasury Secretary Scott Besant recently stated in an interview with Japanese media, "We have no plans to demand specific exchange rate targets from Japan."

Nonetheless, there are still concerns that the US government might pressure the Korean government by claiming that "the weak won has caused the trade deficit" during working-level discussions to abolish tariffs. There is speculation that the US could use the upcoming US Treasury's currency report, expected as early as next month, as leverage to increase pressure. Last November, the US designated Korea as a country under observation in its currency report. A country under observation is a step before being labeled a currency manipulator subject to US sanctions.

The Korean government is likely to emphasize that the recent weakness of the won is due to political uncertainties and that it has been working to curb the rise in the won-dollar exchange rate. In fact, the foreign exchange authorities net sold $3.755 billion in the foreign exchange market in the fourth quarter of last year to slow the decline in the won's value.

There are also arguments that there is no need to excessively worry about the potential for US currency pressure that has not yet materialized.

Lee Chang-yong, Governor of the Bank of Korea, who is visiting the US to attend the 'IMF·World Bank Spring Meetings', said at a press conference held in Washington, DC on the 25th, "Exchange rates are an issue that can easily become politicized, and it is difficult for non-economists to understand the nature of exchange rates," but added, "The US Treasury is a group of exchange rate experts like our Ministry of Strategy and Finance." He further stated, "If both sides with high understanding discuss, much more professional discussions will be possible."

Kim Ik-hwan, Reporter lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.