Editor's PiCK

Imports Surge Ahead of Tariff Imposition... Hampering US Growth

Summary

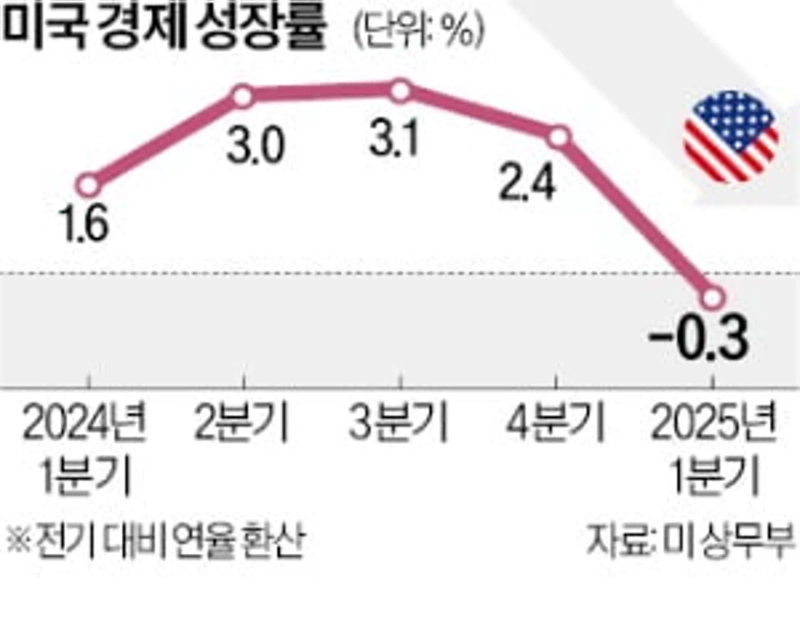

- The US economy recorded a negative growth of -0.3% in the first quarter due to the tariff policy of the Trump administration.

- The surge in imports and reduction in government spending impacted the decline in growth rate, and consumer and corporate economic sentiment deteriorated.

- Due to the uncertainty of future tariff policies, job cuts may appear in the employment market, and concerns about a technical recession have been raised.

Trump Tariff Boomerang... US 'Negative Growth Shock'

Q1 GDP Growth Rate -0.3%

Impact of Increased Imports and Reduced Government Spending

Plummeted by 2.7%P Compared to Last Q4

'Recession' if Negative Growth Continues in Q2

The US economy showed negative growth in the first quarter of this year. The various tariff policies enforced by US President Donald Trump after taking office have boomeranged back on the economy.

Imports Surge Ahead of Tariff Imposition... Hampering US GrowthThe US Department of Commerce announced on the 30th that the preliminary estimate of the economic growth rate for the first quarter was -0.3% (annualized rate compared to the previous quarter). This figure is significantly lower than the market forecast of 0.3~0.8% compiled by Bloomberg, Reuters, and FactSet. It is the first time in three years since the first quarter of 2022 (-1.0%) that the US economy has regressed. Even last year, the US economy was on a growth path with a 1.6% growth in the first quarter, followed by 3.0% in the second quarter, 3.1% in the third quarter, and 2.4% in the fourth quarter. Despite major advanced countries such as the European Union (EU) and Japan falling into growth stagnation, the US economy experienced 'solo growth.'

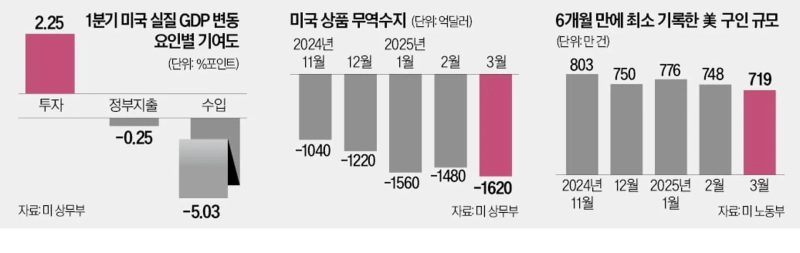

The return to negative growth this year was largely due to the impact of the 'Trump Tariffs.' The biggest factor in the negative growth was the increase in imports as companies increased imports in advance to stockpile inventory ahead of the imposition of tariffs on steel and aluminum in February and March, tariffs on China, and reciprocal tariffs on various countries in April. The US's March goods trade deficit, announced the previous day, surged 9.6% from the previous month to a record high of $162 billion. Bloomberg News reported, "This is the first case where the ripple effect of President Trump's trade policy has appeared."

Signs of a slowdown in employment are also evident. The number of job openings compiled by the US Department of Labor last month was 7.192 million, the lowest in six months. Concerns that tariff imposition will lead to inflation have also dampened consumer sentiment. The consumer confidence index compiled by the US economic research organization Conference Board fell by 7.9 points from the previous month to 86.0 in April, continuing a five-month decline. It is the lowest since May 2020 (85.9). Companies have also increased signs of recession by canceling performance forecasts due to tariff uncertainties.

As the first report card of the Trump administration's second term, which marks 100 days, appears to be poor, criticism of President Trump's economic policy is expected to grow.

Exports Increase by 1.8% While Imports Soar by 41%... Companies "Stockpile Before Tariffs"

Trump Blames Biden... "Unrelated to Tariffs... Be Patient"

The Donald Trump administration, which touted tariff policy as its greatest achievement, received a 'negative' economic report card shortly after commemorating its 100th day in office. Contrary to President Trump's expectations, who claimed, "There is no inflation due to tariffs" and "Tariffs are creating a large number of jobs," the actual business scene showed that the trade deficit was widening and employment was decreasing, indicating that the tariff shockwave had become a reality.

◇ Surge in Imports, Slowdown in Consumption

According to the preliminary estimate of the US GDP for the first quarter announced by the US Department of Commerce on the 30th, the surge in imports dragged down the overall GDP growth rate. Exports increased by only 1.8%, while imports surged by 41.3%, affecting the decline in net exports. In particular, goods imports increased by 50.9%. The Department of Commerce explained that this increase in imports lowered the first quarter growth rate by about 5 percentage points.

Government spending also decreased by 1.4% in the first quarter, contributing to negative growth. In particular, federal government spending decreased by 5.1%. Personal consumption, which supports the US economy, increased by only 1.8%, slowing compared to 4% in the previous quarter.

However, private investment surged by 21.9% as companies preemptively expanded investments in response to tariffs.

Amid the deterioration of consumer and corporate economic sentiment due to the impact of tariffs, if negative growth continues in the second quarter, the US economy will enter a technical recession. However, there are also criticisms that it is limited to read the economic trend based on the first quarter indicators alone. The Financial Times (FT) stated, "There may be distortions in the first quarter GDP due to inventory accumulation ahead of tariff implementation," and "There is a possibility of exaggerating the economic shock." If imports decrease in the second quarter, the growth rate may recover.

Less than an hour after the GDP announcement, President Trump explained through his social media, Truth Social, that the negative growth was not due to his tariffs. He wrote, "This is (former President) Joe Biden's stock market, not Trump's. I did not take over the administration until January 20 (inauguration day)."

He continued, "The bad numbers are unrelated to tariffs," and claimed, "We must clear the 'remnants' left by Biden." Trump also said, "Tariffs will soon take full effect, and companies are relocating to the US on an unprecedented scale," and "When prosperity begins, it will reach levels never seen before, so be patient."

◇ Companies Cutting Jobs Amid Uncertainty

The impact of tariff policy is also negatively affecting the employment market. The logistics industry, in particular, is showing the first signs. UPS, known as the 'economic barometer' for reflecting economic trends first, announced the previous day that it would cut 20,000 jobs, equivalent to 4% of its global workforce, and close 73 logistics facilities in the US by June. This is due to the high-intensity restructuring caused by uncertainty related to tariffs.

Carol Tomé, CEO of UPS, emphasized, "The world has never faced such a massive potential impact in the past 100 years," and "Cost reduction is an unavoidable task now that tariffs have emerged as a major uncertainty factor."

US asset management firm Apollo predicted that container ship operations from China to the US would be suspended in May, and layoffs in the logistics and retail industries would follow in early June. It also saw signs of the shock spreading not only to logistics but also to manufacturing and retail sectors.

Han Kyung-jae/Im Da-yeon Reporter hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.