Markets Ignoring Powell, Betting on 'Stronger and Faster' Rate Cuts [Wall Street Unfiltered]

Summary

- The market's expectations for the Fed's policy have changed significantly, with increased bets on rapid rate cuts.

- Due to signs of weakening in the job market, there is a growing expectation in the market that the Fed will implement rate cuts to prepare for a recession.

- President Trump and some Fed governors are advocating for rate cuts, which contrasts sharply with Powell's cautious stance.

Bets on the Fed's rate cuts are rapidly increasing in the market. This is because concerns about a U.S.-led recession have begun to be seriously reflected, beyond the caution against 'stagflation' due to tariff-induced growth slowdown and inflation. This contradicts the official statements of Jerome Powell, the Fed Chairman, who has maintained a cautious stance on additional rate cuts, as inflation, which seemed to be coming down, could rise again due to tariffs.

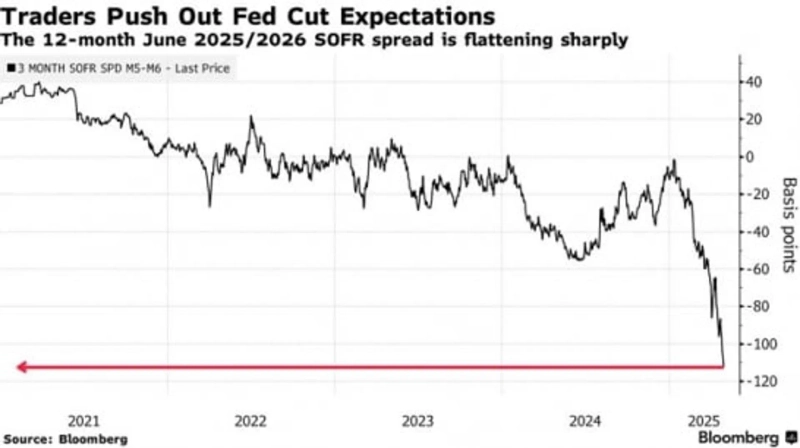

According to Bloomberg on the 30th (local time), the SOFR futures spread, the U.S. risk-free rate indicator, plummeted to -110bp (1bp=0.01% point) on this day. SOFR, the benchmark for U.S. overnight rates, is also used as an alternative indicator of the Fed's policy rate in the options market. The sharp narrowing of the rate gap between the June 2025 and June 2026 contracts means traders are betting that the Fed will cut the benchmark rate by more than 1% point during this period.

Even looking at the CME FedWatch, the probability that the Fed's benchmark rate in December this year will reach 3.25~3.5%, 100bp lower than now, is as high as 93.7%. This means that there is a growing expectation that the Fed will implement four 25bp rate cuts in the remaining five meetings from June to December, even if the May FOMC is skipped.

These market expectations are greatly at odds with Powell's remarks. Powell emphasized in two official speeches in April that "tariffs are very likely to cause at least temporary inflation increases" and that "the central bank has a duty to prevent price increases due to tariffs from becoming entrenched." He also said that the U.S. economy is still robust, so there is no need to rush rate cuts.

This is also why President Trump later referred to Powell as 'Mr. Too Late' and criticized him, saying "he should step down soon." President Trump is vehemently criticizing, "As I predicted, food and energy prices are on a downward trend, so there may be little inflation, but if Mr. Too Late (Powell) does not lower rates now, economic growth could slow."

Why has the market started betting on such rapid rate cuts now? Is it because, as President Trump said, they think there will be no tariff-induced inflation?

Not exactly. The stock market decline so far has been driven by uncertainty due to tariffs and concerns about stagflation. However, Wall Street's consensus is that it has not seriously reflected the risk of a recession. Morgan Stanley pointed out, "The stock market has largely reflected the possibility of a stronger-than-expected growth slowdown, as seen in recent earnings forecast downgrades," but "it has not sufficiently reflected the risk of a mild recession."

In particular, it warned that the market is not prepared for the risk of a recession becoming a reality as the labor market weakens, with the unemployment rate rising by about 200bp and monthly non-farm payrolls increasing by less than 100,000. The most important indicator for determining whether the economy is in a recession is employment, and so far, the U.S. unemployment rate has remained stable at around 4%, so the market has not seriously worried about a recession beyond a growth slowdown. As the job market has not been significantly shaken, income and spending have also been solid. Even if economic growth slows, if jobs are strong, income is maintained, and spending continues despite higher prices due to tariffs, there was a belief that it would not lead to a recession.

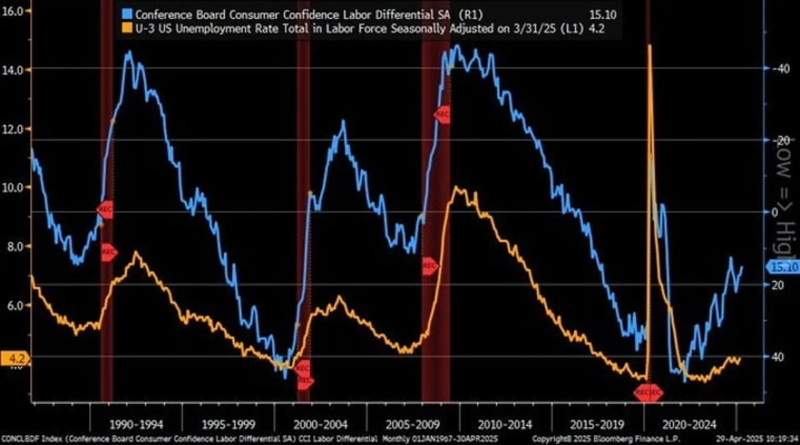

But this belief has begun to shake rapidly. This is because signs of weakening in the once-solid job market have begun to appear. According to data released by ADP, a job information company, the increase in U.S. private employment in April was 62,000, significantly lower than the previous month's 147,000 and the expected 114,000. The outlook for the U.S. labor market, which has historically shown a similar trend to the unemployment rate, is also rapidly deteriorating among U.S. consumers. According to the Conference Board's April consumer survey, the figure that subtracts the response rate of 'it's hard to find a job' from 'there are many jobs' fell to 15.1%. This is the lowest since last September. Renaissance Macro said, "There are many criticisms that the survey does not match reality, but this figure has generally moved similarly when the actual job market deteriorates."

For most investors, a U.S. recession is still not the base scenario. Wall Street's outlook on the possibility of a recession is still at most 50-50. Goldman Sachs said, "If the recession scenario becomes a reality, the U.S. stock market could fall below the recent low (S&P500 4,982 as of the close on April 9)," adding, "If you believe the market will rebound at this point, it is ultimately because of a strong belief that there will be no recession and economic indicators will not deteriorate."

The increase in market bets on the Fed's rapid rate cuts is interpreted in this context. If employment data worsens and recession risks become more real, there is a belief that the Fed will have no choice but to step in. To avoid a recession in the current situation, ① the Trump administration must dramatically ease the level of tariff policy, or ② increase government spending as the Biden administration did, but ③ the Fed cutting rates is considered much more likely by Wall Street and the market.

Even within the Fed, cracks are detected over the need for faster rate cuts. Christopher Waller, a Fed governor, said in an interview on the 24th, "After July, high tariffs could increase the unemployment rate," adding, "We will not overreact to inflation increases due to tariffs, and if the labor market falls significantly, it is important for the Fed to intervene." Beth Hammack, President of the Cleveland Fed, also revealed a similar stance to Waller, saying, "If clear data emerges, we could cut rates in June." This contrasts with Powell's remarks.

President Trump is already prepared to blame 'Mr. Too Late' Fed's high rates, not his tariff policy, if a recession hits. The Fed must be aware of this. Another reason the market thinks the Fed could eventually take preemptive cuts is that, despite inflation concerns, the Fed will not leave the situation unattended until it reaches that point.

For Powell, who is haunted by the nightmare of 'transitory inflation,' he may want to maintain a cautious stance, but if the economy really falls into a recession phase, it becomes a situation where deflation, more frightening than inflation, must be worried about. Although U.S. economic indicators still seem solid, if the impact of high tariffs begins to hit in earnest, the indicators could deteriorate in an instant. The market's circuit betting on the Fed's "more, faster" rate cuts also seems to have a belief that the Fed will not leave the situation unattended until it reaches that point.

New York = Bin Nanse Correspondent binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.