"Ethereum (ETH) Surpasses $1,900 After Withdrawing 85,000 Units... A Signal of Institutional Accumulation?"

Summary

- It was revealed that the background of Ethereum surpassing $1,900 involved 85,000 unit withdrawals and massive stablecoin issuance from exchanges.

- Analyst Amr Taha explained that past large withdrawals have triggered upward volatility.

- Tether's $1 billion USDT issuance suggests institutional accumulation and liquidity inflow.

As Ethereum (ETH) surpassed $1,900, the possibility of institutional funds flowing in is gaining weight as large-scale withdrawals from exchanges and massive stablecoin issuance coincide.

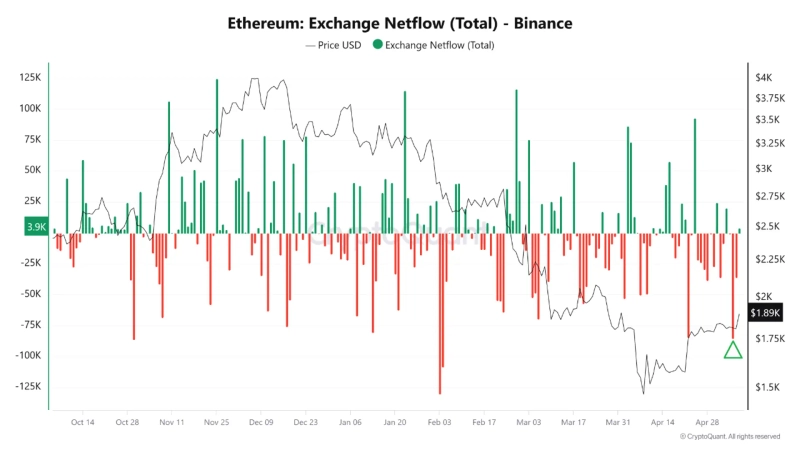

On the 8th, Amr Taha, an analyst at the virtual asset (cryptocurrency) analysis platform CryptoQuant, stated in a Quicktake report, "Just before the recent Ethereum price surpassed $1,900, more than 85,000 ETH were withdrawn from Binance," adding, "This is likely one of the largest withdrawals in recent months."

Analyst Taha explained, "In past cases, such large withdrawals have often led to reduced liquidity within exchanges and thinner sell orders, which often triggered or accompanied upward volatility."

Meanwhile, Tether, the world's largest stablecoin issuer, issued $1 billion worth of USDT on the Tron (TRX) blockchain on the 7th. The analyst analyzed, "The simultaneous occurrence of ETH withdrawals and large USDT issuance can be interpreted as a flow of institutional accumulation and liquidity inflow preparing for an upward trend."

Typically, USDT issuance often reflects the demand of institutional investors or OTC desks preparing to enter the market, and is thus considered a precursor to capital inflow into cryptocurrency assets.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)