Editor's PiCK

Altcoins Surge with 'Korean Investors Return'... XRP Daily Trading Volume Nears 1.4 Trillion Won [Kang Min-seung's Altcoin Now]

Summary

- Recently, Korean investors' altcoin buying trend has surged, significantly increasing the trading volume of major altcoins like XRP.

- The $50 million settlement announcement between the SEC and Ripple positively influenced investor sentiment, with XRP prices rising about 10% after the settlement.

- Experts emphasize the need for investors to adjust positions considering the potential rise of Bitcoin, preparing for a short-term market rebound.

Recently, as U.S. President Donald Trump agreed to significantly reduce mutual tariffs with China for 90 days, the entire virtual asset (cryptocurrency) market recorded a sharp rise. With improved liquidity and major upgrades, the buying trend in the altcoin market, including XRP (Ripple) and Ethereum (ETH), is rapidly increasing.

As of 12:58 PM on the 15th, Ethereum, a leading altcoin, is trading at $2,585 on the Binance USDT market, down 2.12% from the previous day (363,600 won on Upbit). As Ethereum takes a strong rebound trend, major altcoins, including XRP (Ripple), also surged. At the same time, Bitcoin (BTC) dominance is at 62.5%, marking a week-long decline. This suggests that the rebound in altcoins was relatively larger as investment funds moved from Bitcoin to altcoins.

"Korean Investors Have Returned... XRP Buying Trend Surges"

There is an analysis that XRP is showing an upward trend thanks to the concentrated buying trend of domestic investors. Cryptocurrency specialist media DL News reported on the 13th (local time) that "On this day, XRP's daily trading volume on Upbit exceeded $1 billion (about 1.4 trillion won), surpassing the combined trading volume of Bitcoin and Ethereum," and "XRP trading volume has also increased significantly on major Korean cryptocurrency exchanges such as Bithumb, Korbit, and Coinone."

The media continued, "Currently, in the Korean market, aggressive buying is taking precedence over selling," and "This Korean buying fever coincided with the announcement of a $50 million settlement between Ripple and the U.S. Securities and Exchange Commission (SEC)." According to domestic cryptocurrency exchange Upbit, XRP price rose about 10% to around 3,580 won after the settlement with the SEC.

Previously, the U.S. Securities and Exchange Commission (SEC) submitted a settlement proposal to the court on the 8th to conclude the lawsuit against Ripple co-founder Chris Larsen and Ripple CEO Brad Garlinghouse. In addition, signs of easing U.S.-China trade tensions are contributing to the recovery of expectations for the overall altcoin market.

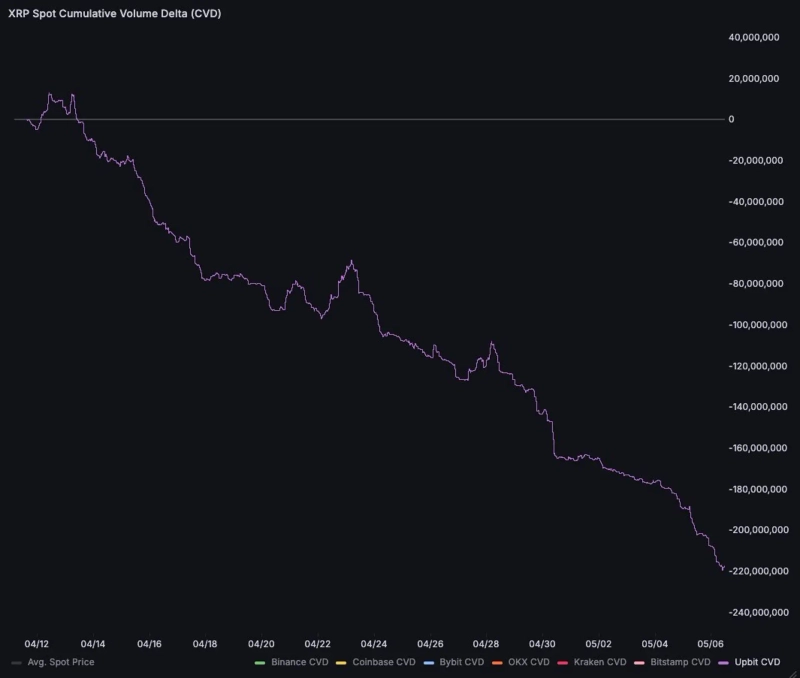

According to FX Empire data, domestic investors have net sold about $500 million worth of XRP on Upbit over the past month since April 11. As the market trend rapidly changed with the submission of the settlement proposal with the SEC and the U.S.-China trade agreement, the XRP supply and demand flow of Korean investors also changed rapidly in just one month.

"Altcoin Investment Sentiment Recovers... Signs of Supply Improvement Detected"

Investment sentiment in the overall cryptocurrency market is also showing signs of recovery. While Bitcoin is hovering around $103,000, the trading volume and network activity of major altcoins centered on Ethereum are increasing, indicating signs of supply improvement. Although some small altcoins show signs of overheating, the overall market is forming a bullish structure with various buying incentives such as ETF expectations, regulatory risk mitigation, and liquidity expansion from China.

Recovery signals are appearing in the overall cryptocurrency market. On-chain data analysis company Santiment reported in a research report on the 14th that "Market sentiment has noticeably rebounded since mid-May," and "Ethereum is leading the recovery of investment sentiment, with trading volume and network activity increasing simultaneously across major altcoins." They added, "It is noteworthy how this trend will continue in the coming weeks."

The report also stated, "Some small altcoins show signs of overheating, but overall, a healthy circulation structure commonly seen in bull markets is forming," and "In medium-cap altcoins and above, transaction based on real use, such as dApps, is increasing, and interest in DeFi and Layer 2 project tokens is gradually recovering."

Global cryptocurrency exchange Bybit also stated in a research report that "Ethereum did not show a clear rebound trend even after the spot ETF approval, and concerns over foundation leadership increased investor disappointment," but "Ethereum turned into a surge after the 'Pectra' upgrade on the 7th, and along with this, a large number of short positions were liquidated in the derivatives market, further expanding the rise."

The report continued, "With the Pectra upgrade, the staking cap per node has been significantly expanded from 32 ETH to 2048 ETH, increasing the possibility of including staking rewards in the Ethereum spot ETF in the future." Recently, Ethereum co-founder Vitalik Buterin proposed a technical transition that could improve Ethereum to a simple structure like Bitcoin within five years and increase throughput by up to 100 times. The industry is gaining more confidence in Ethereum's mid- to long-term outlook.

On the other hand, some believe that the bullish trend centered on Bitcoin will continue structurally. Cryptocurrency data analysis company Kaiko recently stated in a report that "In past cycles, the so-called 'alt season' eventually came when funds circulated to small altcoins, but this cycle is somewhat different." They continued, "It is difficult to see the current situation where Bitcoin dominance has surged as immediately leading to altcoin strength," and "Rather, the market structure change supports the sustainability of the Bitcoin-centered structure."

Kaiko also stated, "Recently, corporate demand to incorporate Bitcoin as a strategic asset is increasing, and this strategy is also expanding to altcoins," and "Some companies, including cryptocurrency market maker GSR, are including Solana (SOL) in their holdings and are expanding it." They added, "In the overall meme coin market, Official Trump (TRUMP) once accounted for more than 50% of trading volume, securing dominance within the meme coin sector."

Additionally, there is an analysis that the market is unlikely to plummet in the short term. Global cryptocurrency exchange Bitfinex reported in a weekly report that "BlackRock argued that staking functionality should be introduced in Ethereum-based ETFs, proposing an expansion of ETF product functions." They continued, "Cryptocurrency leader Bitcoin has risen on a structurally solid foundation with increased spot trading volume and institution-led ETF inflows," and "As long as the macroeconomic environment remains favorable, short-term market adjustments are likely to be quickly absorbed by buying pressure."

Cryptocurrency strategist Michaël van de Poppe also stated in a recent YouTube broadcast, "After the recent surge in the altcoin market, many traders are asking, 'Will the gains be given back this time as well?' but the point at which such a strong breakout occurs may be a moment that suggests the possibility of a reversal in the market structure itself." He added, "The rebound phase of the yuan can also be one of the macroeconomic backgrounds that can support further rises in the cryptocurrency market." This is interpreted as a signal of liquidity expansion from China, coinciding with the recovery of investment sentiment in risky assets, which could be a precursor to a market reversal in the future.

He explained, "Altcoins fall deeply when they decline, but when the upward transition begins, the speed is very fast. In early 2021 and 2023, many altcoins surged 3 to 10 times in a short period." He emphasized, "To maximize compound returns in the future, it is important to maintain positions as long as possible at the beginning of this rebound phase."

Meanwhile, the market is also raising the possibility of a price correction. Cryptocurrency analyst Benjamin Cowen also stated on his YouTube channel, "If Bitcoin fails to break its previous high by summer and faces downward pressure in August-September, Ethereum may also test its low again." He added, "Currently, the altcoin (ALT/ETH) indicator relative to Ethereum is approaching the cycle's high range, and as in the past, altcoins may show a downward trend as funds are dispersed. Investors need to be prepared for both paths."

Kang Min-seung, Bloomingbit Reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)