Summary

- Bitcoin recently surpassed $100,000, emphasizing its role as a 'store of value.'

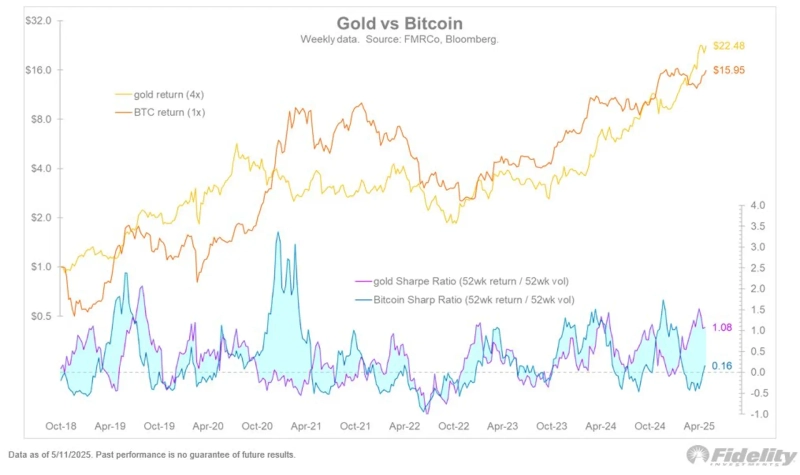

- Jurrien Timmer, Fidelity Director, stated that Bitcoin's Sharpe Ratio is converging with gold, indicating Bitcoin's advantage over gold in the risk-adjusted return structure.

- Bitcoin Suisse explained that the rise in Bitcoin's Sharpe Ratio is positively evaluated, gaining popularity among various investors.

Bitcoin (BTC) recently surpassed $100,000, emphasizing its role as a 'store of value,' according to analysis.

On the 19th (local time), Cointelegraph, a cryptocurrency-focused media outlet, reported that Jurrien Timmer, Fidelity's Global Macro Director, analyzed in a report that "Bitcoin's Sharpe Ratio (risk-adjusted return indicator) is converging with gold."

Regarding this, Director Timmer explained, "This shows that Bitcoin is catching up with gold in terms of risk-adjusted returns. While Bitcoin and gold share the common characteristic of being a store of value, they exhibit the most negative correlation with each other. Bitcoin holds an advantage over gold in the risk-adjusted return structure."

Additionally, Director Timmer recommended setting the investment ratio of Bitcoin to gold at 1:4 for risk hedge investments.

Meanwhile, it is expected that a higher Sharpe Ratio will have a positive impact on Bitcoin. Bitcoin Suisse explained, "Since the U.S. presidential election, Bitcoin's Sharpe Ratio has been continuously rising, gaining popularity among both risk-seeking and risk-averse investors."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)