'Combination of Bitcoin and Real Estate'... Cardone Capital Launches Miami River Bitcoin Fund

Summary

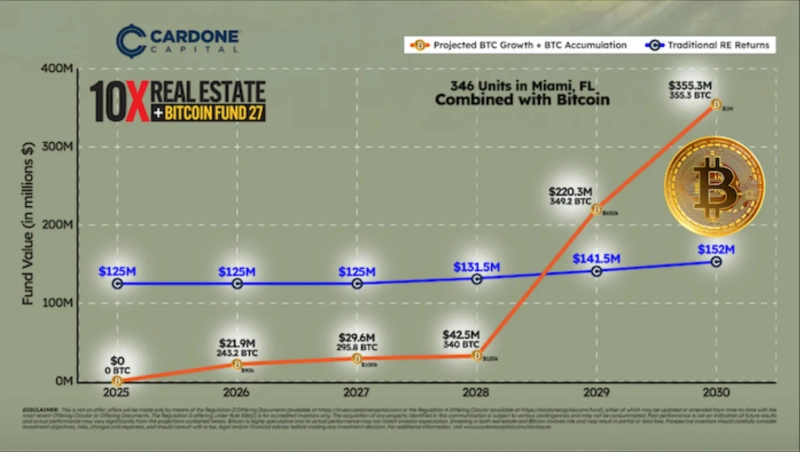

- Cardone Capital announced the launch of a dual asset fund combining real estate and Bitcoin.

- The fund structure consists of 346 Miami real estate units and $15 million in Bitcoin.

- Founder Grant Cardone stated that they are providing opportunities for investors to participate without technical knowledge of Bitcoin.

An investment product has emerged that bundles Bitcoin (BTC) with other assets. This time, it's a combination of real estate and Bitcoin.

According to Cointelegraph, a cryptocurrency-focused media outlet, on the 25th (local time), real estate investment firm Cardone Capital has launched a dual asset fund, the '10X Miami River Bitcoin Fund', consisting of 346 Miami real estate units and $15 million in Bitcoin.

Grant Cardone, founder of Cardone Capital, said, "A friend advised me to look at what kind of performance could have been achieved if all cash flow from real estate had been converted to Bitcoin over the past 12 years," adding, "That's why we created a product to invest cash from real estate into Bitcoin."

Cardone further stated, "Through this product, both investors and tenants can be onboarded to Bitcoin without technical knowledge," and added, "We are also considering offering Satoshis as a reward for this product."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)